The following is a list of methods that is provided by the Employer Plan Service.

- AddEmployerPlan – Used to add an employer’s plan information.

- DeleteEmployerPlan – Used to remove an employer’s plan.

- UpdateEmployerPlan – Used to update an employer’s plan.

- GetEmployerPlan – Used to retrieve an employer’s plan.

- GetEmployerPlans – Used to retrieve all employers’ plans.

- SetPlanPriority – Used to set plan priority for all plans associated with an employer.

- GetPlanPriority – Used to get a list of plans in priority order.

The Employer Plan Service makes the following assumptions as well as enforce the following business rules.

- Clients shall conform to the WS-I specifications unless otherwise agreed upon by Alegeus Technologies and the administrator.

- Clients shall format SOAP messages in a Document/Literal format over HTTPS.

- Clients shall have already created a valid user ID and password.

- Clients shall have a valid session ID after being authenticated by the system. The session ID needs to be passed in the proper manner as described in the Account Manager Service Guide.

- If the administrator uses the same user ID and password for all of their clients, the administrator is responsible for managing the security of the data.

- Clients should validate data before submitting a request to this Service. This facilitates better performance and accurate processing on both systems.

- Clients shall not attempt to use this service for batch processing of large amounts of data. The service is designed for synchronous calls that send or retrieve small chunks of data. If batch processing is required, then the EDI process should be used.

- If any method fails, the service returns a SOAP fault describing the problem.

- Employer Plan Service is meant to be used only by non-split plan administrator.

AddEmployerPlan

This method is used to add an employer’s plan information.

History

The AddEmployerPlan methods are listed below:

- AddEmployerPlanRequest_2024_03

- AddEmployerPlanRequest_2023_10

- AddEmployerPlanRequest_2023_03

- AddEmployerPlanRequest_2021_11

- AddEmployerPlanRequest_2021_02

- AddEmployerPlanRequest_2020_02

- AddEmployerPlanRequest_2019_10

- AddEmployerPlanRequest_2019_03

- AddEmployerPlanRequest_2018_02

- AddEmployerPlanRequest_2012_10

- AddEmployerPlanRequest_2012_06

- AddEmployerPlanRequest_2011_04

- AddEmployerPlanRequest_2010_10

- AddEmployerPlanRequest_2010_04

- AddEmployerPlanRequest_2009_04

- AddEmployerPlanRequest_2008_07

- AddEmployerPlanRequest_2007_12

- AddEmployerPlanRequest_2006_05

- AddEmployerPlan

- AddEmployerPlanResponse

The AddEmployerPlan method requires the following request and response messages (input and output data).

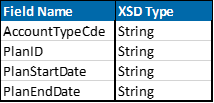

The table below includes the following request messages:

- AddEmployerPlanResponse_2023_03

- AddEmployerPlanResponse_2021_11

- AddEmployerPlanResponse_2021_02

- AddEmployerPlanResponse_2020_02

- AddEmployerPlanResponse_2019_06

- AddEmployerPlanResponse_2019_03

- AddEmployerPlanResponse_2018_02

- AddEmployerPlanResponse_2012_10

- AddEmployerPlanResponse_2012_06

- AddEmployerPlanResponse_2011_04

- AddEmployerPlanResponse_2010_10

- AddEmployerPlanResponse_2010_04

- AddEmployerPlanResponse_2009_04

- AddEmployerPlanResponse_2008_07

- AddEmployerPlanResponse_2007_12

- AddEmployerPlanResponse_2006_05

- AddEmployerPlanResponse

Request Body

- TpaIdStringrequiredA unique identifer for your administrator instance, generated by WCA when the instance was first set up.

First Available Version: AddEmployerPlanRequest - EmployerIdStringrequiredUnique identifier for the employer. Note: When the employer was created, WealthCare Admin assigned the 3-character prefix; you assigned the remaining characters.

First Available Version: AddEmployerPlanRequest Max Length: 12 - PlanIdStringrequiredUnique Identifier to distinguish this plan from others within the administrator.

Could be a combination of Plan ID, Account type, Effective Date and Expire Date.First Available Version: AddEmployerPlanRequest Max Length: 18 - AccountTypeCodeStringrequiredThree character abbreviation that indicates the type of account (FSA, DCA, TRN, HRA, and so on).

First Available Version: AddEmployerPlanRequest - PlanYearStartDateDaterequired(YYYMMDD)Date that funds are available for services.

First Available Version: AddEmployerPlanRequest - PlanYearEndDateDaterequired(YYYMMDD)Date after which services are not eligible for payment, unless there is an extension in the field.

First Available Version: AddEmployerPlanRequest - GracePeriodEndDateDaterequiredDate the grace period ends for this account. After this date, a warning displays when transactions are applied to this account type. This field corresponds to the UI field: “Run Out Date”

First Available Version: AddEmployerPlanRequest - PlanYearExtendedEndDateDateDate the extended period for this account type ends. After this date, a warning displays when POS transactions are applied to this account type. This field corresponds to the UI field: “Grace Period” or “IRS Grace Period/Extension Date”

First Available Version: AddEmployerPlanRequest - SpendingLimitPeriodEnumerationDetermines if this account type uses spending limits. Spending limits restricts the amount of money that can be deposited into or withdrawn from an account on a monthly or yearly basis. Valid values are:

None

Month

Year

CarryoverFirst Available Version: AddEmployerPlanRequest Default Values: None - SpendingDepositAmountDecimalMaximum amount to be deposited, during the spending Limit period.

An error message is returned if the ‘carryover’ option is selected for spending limit period: Spending deposit amount cannot be set when spending limit period is set to carryover.First Available Version: AddEmployerPlanRequest - SpendingTransactionAmountDecimalMaximum amount to be withdrawn, during the spending limit period.

An error message is returned if the ‘carryover’ option is selected for spending limit period: Spending transaction amount cannot be set when spending limit period is set to carryover.First Available Version: AddEmployerPlanRequest - AllowPartialManualTransactionBooleanSpecify if this account type allows partial payments of Manual Transactions

0 (false) - Pay what is left in account towards Manual Transactions

1 (true) - Deny Manual Transactions if the entire amount is not available.(Default)

(This applies to transactions submitted via EDI only)First Available Version: AddEmployerPlanRequest Default Values: FALSE - AutoDepositBypassBooleanCorresponds to the Hold Account Funding UI option in WCA. Set this flag to True to discontinue any future scheduled auto deposits. Setting this flag to False enables auto deposits and catching up on any missed auto deposits, even those that occurred while this flag was set to True.

First Available Version: AddEmployerPlanRequest Default Values: FALSE - ConvenienceFeePayorEnumerationWho will pay the convenience fee. Valid values are:

None

Administrator

Employer

Employee

Note: "none" indicates that no fee is appliedFirst Available Version: AddEmployerPlanRequest Default Values: None - ConvenienceFeeAmountDecimalConvenience amount charged for each POS transaction. This field is only used if the employee is paying the fee.

First Available Version: AddEmployerPlanRequest Max Length: 10 - MaxTransactionAmountDecimalMaximum amount exchanged per transaction under the plan.

First Available Version: AddEmployerPlanRequest Max Length: 10 - MaxTotalAmountDecimalMaximum amount to be paid out over the Account Type’s date range.

First Available Version: AddEmployerPlanRequest Max Length: 10 - DefaultPlanOptionsIntegerSet this field if the administrator wishes to use the default plan functionality.

0 - None(Default)

1 - Plan

2 - MTC

This is a bit field, so a sum value should be sent if the administrator wishes to use the combination of defaults. Ex. if the administrator wants to create a Plan with Plan design defaults and MTC defaults, they have to set this field as 3 (1 + 2). See the bit field guide for more information.First Available Version: AddEmployerPlanRequest - RolloverPlanBooleanDetermines if the plan will have a rollover.

First Available Version: AddEmployerPlanRequest Default Values: FALSE - RolloverPlanAttributesEnumerationIf Plan Rollover is set to True and Plan Rollover Attributes has no value, WCA rolls over MTC codes and TPS settings. Valid Values are:

Merchant Type Codes

Plan Design Exceptions

Merchant Exceptions

Terminal Exceptions

Co-Pay Amounts for Auto-

AllFirst Available Version: AddEmployerPlanRequest Default Values: -1 - ProductPartnerAccountFeeIntegerAllows the Product Partner to determine whether the monthly fee charged per participant is discounted or whether you receive a commission.

1=Commission to administrator, agency, or company

2=Discount to participant

Note: Leave blank if this plan is not a Product Partner HSA.First Available Version: AddEmployerPlanRequest_2006_05 Default Values: 0 - ProductPartnerSetupFeeIntegerAllows the Product Partner to determine whether the setup fee charged per participant is discounted or whether you receive a commission.

1=Commission to administrator, agency, or company

2=Discount to participant

Note: Leave blank if this plan is not a Product Partner HSA.First Available Version: AddEmployerPlanRequest_2006_05 Default Values: 0 - ProductPartnerIssueCheckbooksBoolean

Determines whether a participant receives a checkbook.

0 = No

1 = Yes

Note: Leave blank if this plan is not a Product Partner HSA.First Available Version: AddEmployerPlanRequest_2006_05 Default Values: FALSE - ProductPartnerEmployerIdStringThis is an additional employer identifier defined by the product partner, if requred by them, or may otherwise be defined by the administrator. Can be used to store employer tax ID or some other value associated with the employer.

Note 1: Leave blank if the plan is not an HSA.

Note 2: This field is required for HSA type plans. If the product partner employer ID is not provided, the record will fail.First Available Version: AddEmployerPlanRequest_2006_05 - ProductPartnerAdministratorIdStringThe value in this field links the administrator with the product partner. The product partner provides this ID for the administrator.

Note 1: Leave blank if the plan is not an HSA.

Note 2: This field is required for HSA type plans. If the administrator ID is not provided, the record will fail because the product partner relationship will not be found.First Available Version: AddEmployerPlanRequest_2006_05 - ProductPartnerProductIdStringUnique identifier for the Product Partner.

Note 1: Leave blank if the plan is not an HSA.

Note 2: This field is required for HSA type Plans. If the Product Partner Employer ID is not provided, the record will failFirst Available Version: AddEmployerPlanRequest_2006_05 - IiasSettingsEnumerationIndicates if and how IIAS is used for this plan. Valid options are:

0 = IIAS disabled (Default)

1 = IIAS Enabled for HET

2 = IIAS and Specific healthcare amount

4= IIAS Walgreens

8 = IIAS SIGIS

By making this selection to enable IIAS, Iyou are agreeing to the terms and conditions of the IIAS terms of use.First Available Version: AddEmployerPlanRequest_2007_12 Default Values: IIAS Disabled - IiasOptionsEnumerationIf IIAS Enabled = 0, then send IIAS Options = 0

If IIAS Enabled = 1, then 0 indicates HET

If IIAS Enabled = 2, then send the following IIAS Options value of 1 = RX

Note: The IIAS Options field is used by the administrator when not using HET. Rx and OTC are the only supported options at this time.

The options are:

0 = No, Healthcare Specific(Default)

1 = RxFirst Available Version: AddEmployerPlanRequest_2007_12 Default Values: None - CoverageTierT ypeIdStringMaps to an administrator level coverage tier type (4 tier, 3 tier, etc.) as created by you via the User Interface (UI). This field is required if plan is enabled for coverage tiers (see Plan Options field). Only one coverage tier type ID can be assigned per plan. Leave field blank if not using coverage tiers.

First Available Version: AddEmployerPlanRequest_2008_07 Max Length: 10 - DefaultCoverageTierIdStringMaps to a coverage tier (Single, Family, etc.). Required if plan is enabled for coverage tiers. Tier ID provided must be a valid coverage tier ID within the Coverage Tier Type specified.

Employee accounts are updated nightly to use the plan default coverage tier if none is defined when creating the employee account.

Leave field blank if not using coverage tiers.First Available Version: AddEmployerPlanRequest_2008_07 Max Length: 10 - LifeEventCalculationMethodsEnumField ignored unless Plan Options set to allow Life Event Management.

If Plan options is set to allow life event balance management, then valid values for this field are:

None

AnnualDisbursements

MaximumBenefitsFirst Available Version: AddEmployerPlanRequest_2008_07 Default Values: None - OtherDepositSubTypeIdsStringUsed for Special Deposits functionality. Specify the OtherDepositSubTypeIds to be used

First Available Version: AddEmployerPlanRequest_2008_07 - ManualClaimPercentCoverageIntegerPercentage of claim amount that should be paid from the funds in the employee’s account attached to this plan.

Plan “Allow Partial Manual Transactions” must be set to “Yes” in order to utilize this feature.

Whole amounts >= 0 and <= 100 are accepted. For example, 50 is allowed. The default value is 100%.

If the Manual Claim Percentage Coverage feature is not enabled at the administrator level, and the percentage value is provided, then WCA will return an error.

This setting cannot be used if the Deductible Rules feature is enabled for the plan as percentage based rules are definable in the deductible rule settings. Please see Manual Claim Processing Enhancements for more details.First Available Version: AddEmployerPlanRequest_2008_07 Default Values: 100 - IndividualBalanceMaxDecimalThis amount indicates the maximum balance that is allowed for the Individual Amount within the participant’s account after funds have been rolled from another account into this account. The Fund Rollover amount will be limited such that the Individual amount balance after funds have rolled into this account does not exceed the Fund Rollover Individual Balance Max specified. Only set for individual amount in an Individual/Family HRA account.

First Available Version: AddEmployerPlanRequest_2008_07 Default Values: 0Max Length: 19 - RolloverBalanceMaxDecimalFor example, a participant’s balance is $600 in the target account and the Fund Rollover Balance Max is set to $1000. If the source fund has $750 of eligible funds to roll into this account, the rollover amount will be limited to $400 rather than rolling the full $750 so that the balance in the participant’s account to which funds are being rolled is $1000. This amount is also used for the family amount in an Individual/Family HRA account and for the Interest Bearing feature in WCA.

First Available Version: AddEmployerPlanRequest_2008_07 Default Values: 0 - DefaultDeposit CalendarIdStringID of calendar to use as the participant auto deposit default calendar for this plan.

To use, enable “Multiple Payroll Calendars” feature at the administrator level and setup your calendars/Ids (see Account Funding How To Guide for details).First Available Version: AddEmployerPlanRequest_2008_07 Max Length: 50 - FixedEmployerFundingCalendarIdStringCalendar ID provided sets the Fixed Employer Funding deposit cycle for all participants associated with the plan.

To use, enable “Fixed Employer Funding” feature at the administrator level and setup your calendars/Ids (see Account Funding How To Guide for details).First Available Version: AddEmployerPlanRequest_2008_07 Max Length: 50 - FixedEmployerFundingAmountDoubleEnable “Fixed Employer Funding” at the administrator level to use this field.

If using a Fixed Employer Funding Calendar, then this amount is the amount to be deposited per pay period to the participant’s account.

If not using a Fixed Employer Funding Calendar, then this amount is the single deposit amount to be credited to an employee account after the account and card (for card enabled employers) are created. Note: Deposits occur nightly following creation of account/card. If this amount is altered mid-plan year and

The Plan is using a Fixed Employer Funding Calendar, the new amount is what will be deposited on the next deposit date.

The Plan is not using a Fixed Employer Funding Calendar, only newly created accounts receive the new deposit amount (no change to existing accounts).First Available Version: AddEmployerPlanRequest_2008_07 Default Values: 0Max Length: 19 - FixedEmployerFundingAmountIndividualDoubleFor HRX plans only. The individual amount per pay period funded by employers.

Note: There is no increase in contributions YTD for Individual amounts.First Available Version: AddEmployerPlanRequest_2008_07 Default Values: 0Max Length: 19 - PlanOptionsShortSet this field if the administrator wishes to use the default plan functionality.

None(Default) = 0

AuthorizedTransit = 1

LifeEventBalanceManagement = 2

EnableCoverageTiers = 4

EnableSpecialDeposit = 8

ManualClaimPercentCoverage = 16

EnableDeductible = 32

DefaultAcctCrossover = 64

ServiceCategory = 128

AcctWithDeductibleFlag = 256

AcctWithDeductibleManager = 512

AutoIssueCard = 1024

EnforceEmpeContributionLimit = 2048

EnableEnrollmentSetup = 4096

EnablePlanDivClsCalSetup = 8192

EnablePayrollFunded = 16384

This is a bit field, so a sum value should be sent if the administrator wishes to use the combination of defaults. Ex. if administrator wants to create a Plan with Plan design defaults and MTC defaults, they have to set this field as 3 (1 + 2). See the bit field guide for more information.First Available Version: AddEmployerPlanRequest_2008_07 Default Values: 0 - ExtDeductibleShortExternal Deductible Not Supported - 0

External Deductible Supported - 1First Available Version: AddEmployerPlanRequest_200 9_04 - AllowClaimsCrossoverIntegerFlag to identify whether claim crossover is enabled (i.e., can claims auto-pay from the account) at the plan level or not

Not allow - 0

Allow - 1First Available Version: AddEmployerPlanRequest_2009_04 Default Values: 0 - ClaimsCrossoverParticipantDefaultIntegerIf plan is setup to allow claims cross over auto pay, this field specifies the default opt in value when assigning employees to benefit accounts.

0 = Opt Out (Default)

1 = Opt In

Note: When assigning employees to this benefit plan, the opt in value can be set during enrollment. The default is only used if the opt in value is not set during enrollment.First Available Version: AddEmployerPlanRequest_2009_04 Default Values: 0 - Annual ElectMinDecimalThis value will define what the minimum annual election amount entered for the employee can be.

Note: The following rules apply for this field:

This can be left blank.

If populated, this value must be less than the maximum annual election amount. If a value is entered this must be greater than zero.First Available Version: AddEmployerPlanRequest_2009_04 Default Values: 0 - Annual ElectMaxDecimalThis value will define what the maximum annual election amount entered for the employee can be.

Note: The following rules apply for this field:

This can be left blank.

This value must be greater than the maximum annual election amount. If a value is entered this must be greater than zero.First Available Version: AddEmployerPlanRequest_2009_04 Default Values: 0 - EnforceEmployeeContributionLimitBooleanEnforce employee annual election. If this is set to true, then payroll contributions added manually (or using data exchange) will not increase the annual election. If a payroll calendar is linked to the plan, then the employee's per pay period amount will automatically adjust to keep the annual election the same.

First Available Version: AddEmployerPlanRequest_2009_04 Default Values: FALSE - TermEmpeRunOutDaysIntegerThis field may be used to set the run out days for a plan.

First Available Version: AddEmployerPlanRequest_2010_04 Default Values: 0 - TrackingNumberStringTracking Number which is returned with the response. WCA does not use this field; it is intended to help you correlate requests/responses.

First Available Version: AddEmployerPlanRequest_2010_10 Default Values: Blank - AllowAutoReimbSettingsInt16Use this field to indicate whether or not the plan will allow auto pay provider reimbursements.

1. = No (Default)

2. = YesFirst Available Version: AddEmployerPlanRequest_2010_04 Default Values: 0 - AutoReimbParticipantDefaultInt16conditionally requiredThis field will specify a default account setting for participants enrolled in a plan using auto provider pay.

1. = No (Default)

2. = Yes

Note: This field is required when setting the plan to “Auto Provider Pay” = 1 (Yes).First Available Version: AddEmployerPlanRequest_2010_04 Default Values: 0 - ReimburseAmountsAppliedToDeductibleAccountBooleanUse this field to indicate whether or not the plan will reimburse amounts applied to the deductible tracking plan type (DTR). If the account is setup to reimburse amounts applied to the DTR plan, the DTR plan must be a higher priority plan and the claim must be submitted using Service Category Codes (SCCs) to make sure the manual claim splits properly.

False = No, the plan will not allow reimbursement of the deductible applied amounts (Default).

True = Yes, the plan will allow reimbursement of the deductible applied amounts.

Note: This option can be set only to Non Deductible Plan Types. If it is set for Deductible Plan Types, the option is just ignored rather than throwing the error.First Available Version: AddEmployerPlanRequest_2010_04 Default Values: FALSE - MerchantSubstantiationBooleanTrue – Enables Merchant Substantiation on the plan

False – Disabled Merchant Substantiation on the planFirst Available Version: AddEmployerPlanRequest_2012_06 Default Values: FALSE - CustomDescriptionStringThe custom description will display on WealthCare Portal and WealthCare Mobile, replacing the WCA default plan description text.

First Available Version: AddEmployerPlanRequest_2012_10 Max Length: 75 - HidePlanFromParticipantBoolean

Hides the plan from participant users (WealthCare Portal, WealthCare Mobile, and Participant APIs).

0 – Displays plan to Participants (Default)

1 – Hides plan from ParticipantsFirst Available Version: AddEmployerPlanRequest_2013_06 Default Values: FALSE - TrustPlanIDStringID associated with external HSA investments.

First Available Version: AddEmployerPlanRequest_2015_06 - LinkPlanBooleanIndicates if plan should be automatically linked to HRA.

0 = false

1 = trueFirst Available Version: AddEmployerPlanRequest_2016_06 Default Values: TRUEMax Length: 1 - LinkedPlanYearStartDateDateTimeStart date of HRA plan to be linked

Optional if Link Plan is false

Required if Link Plan is trueFirst Available Version: AddEmployerPlanRequest_2016_06 Max Length: 8 - LinkedPlanYearEndDateDateTimeEnd date of HRA plan to be linked

Optional if Link Plan is false

Required if Link Plan is trueFirst Available Version: AddEmployerPlanRequest_2016_06 Max Length: 8 - LinkedPlanIdStringPlan ID of HRA plan to be linked

Optional if Link Plan is false

Required if Link Plan is trueFirst Available Version: AddEmployerPlanRequest_2016_06 Max Length: 18 - LinkedAccount TypeCodeStringAccount type of HRA plan to be linked.

Optional if Link Plan is false

Required if Link Plan is trueFirst Available Version: AddEmployerPlanRequest_2016_06 Max Length: 4 - HraTypeEnumHRA type. Valid values are:

None (default. Use this if not creating a complex HRA)

IndividualFamilyAmt

SingleFundHraFirst Available Version: AddEmployerPlanRequest_2016_06 - OnHoldTxnBooleanUse this field to determine whether the plan will allow on hold transactions.

0 = false

1 = trueFirst Available Version: AddEmployerPlanRequest_2016_06 Default Values: TRUEMax Length: 1 - DisableQleAmountEditBooleanUse this field to determine whether the option to edit Amounts is disabled.

1. = False, ability to edit amount is enabled.

2. = True, ability to edit amount is disabledFirst Available Version: AddEmployerPlanRequest_2016_06 Default Values: TRUEMax Length: 1 - ProrationScheduleIDStringBlank (default) = The plan does not support prorated employer funding.

Any valid proration schedule ID = Yes, the plan supports prorated employer funding with the specified schedule.

Note: If a proration schedule ID is submitted, the ‘Does the funding amount change based on age?’ and ‘Does the funding amount change with the number of dependents?’ fields must not be enabledFirst Available Version: AddEmployerPlanRequest_2018_02 Max Length: 18 - AllowPartialPayrollDepositsBooleanIndicates whether deposits over the Employee’s Annual election amount will be partially accepted.

0 = No (default)

1 = Yes

Note: To enable this option, the ‘enforce employee annual election’ must also be enabled on this plan.First Available Version: AddEmployerPlanRequest_2018_02 Default Values: 0Max Length: 1 - UserDefinedFieldStringStores the value of the user defined field created at the plan level. WealthCare Admin does not use the field.

First Available Version: AddEmployerPlanRequest_2018_06 Max Length: 50 - CarryoverLimitEnumWhen spending limit period is ‘3’ (carryover), the following values can be entered:

0 – None

1 – All

2 – Cap

4 – Percent

8 – Percent up to capFirst Available Version: AddEmployerPlanRequest_2019_03 Default Values: 0Max Length: 1 - CarryoverMinimumDecimalWhen spending limit period is ‘3’ (carryover), use this field to specify the minimum available balance amount needed to be eligible for carryover. Values must be 0 or greater.

First Available Version: AddEmployerPlanRequest_2019_03 Max Length: 19 - CarryoverCapDecimalSpecifies the cap when option ‘2’ or ‘8’ is entered for the carryover limit field.

Note: If carryover limit field is set to any other option than ‘2’ or ‘8’, anything included in this field returns an error.First Available Version: AddEmployerPlanRequest_2019_03 Max Length: 19 - CarryoverPercentIntegerSpecifies the percentage when option ‘4’ or ‘8’ is entered for the carryover limit field.

Note: If carryover limit field is set to any other option than ‘4’ or ‘8’, anything included in this field returns an error.First Available Version: AddEmployerPlanRequest_2019_03 Max Length: 19 - HideEmployerContributionBooleanHides employer contribution information in WealthCare Portal and WealthCare Mobile

0 - No, employer contributions will not be hidden from participant (default)

1 - Yes, employer contributions will be hidden from participantFirst Available Version: AddEmployerPlanRequest_2019_06 Default Values: 0Max Length: 1 - HideDeductibleBooleanHides deductible status messaging in WealthCare Portal and WealthCare Mobile

0 - No, deductible messaging will not be hidden (default)

1 - Yes, deductible messaging will be hiddenFirst Available Version: AddEmployerPlanRequest_2019_06 Default Values: 0Max Length: 1 - PlanUsageDescrptionStringHelpful description of plan usage to appear in WCM.

First Available Version: AddEmployerPlanRequest_2019_06 Max Length: 1000 - EnableAccount DormancyBooleanDormancy means participants can receive deposits, but they will not be able to use the funds for claims or card transactions. If dormancy is enabled, service category codes and merchant category codes should not be assigned. By enabling this setting, balance labels on WCP/WCM, transaction denial codes, participant communications and reporting may be impacted.

False – No, do not enable dormancy (default)

True – Yes, enable dormancy

Note: If the plan is an HSA, VEBA, or card reimbursement (CRA) plan type and ‘1’ is passed to enable dormancy, the request will fail with an error. HSA and VEBA are not compatible with dormancy.

Note 2: Currently, web services do not support creation or update of subgroups.First Available Version: AddEmployerPlanRequest_2019_10 Default Values: FALSEMax Length: 1 - ShowCustomPlanDescriptionInCoveragePeriodsBooleanIf enabled, the custom plan description configured for each plan or subgroup will display within the coverage period details section of WCP.

False - not enabled (default)

True – enabled

Note: Currently, web services do not support creation or update of subgroups.First Available Version: AddEmployerPlanRequest_2019_10 Default Values: FALSEMax Length: 1 - PlanUsageDescriptionHTMLStringHelpful description of plan usage (in HTML format) to appear in WealthCare Portal.

Note: If subgroup is provided on the record, setting will be applied to the specified subgroup. If subgroup is not provided on the record, setting will be applied to the base plan.First Available Version: AddEmployerPlanRequest_2019_10 Default Values: Empty stringMax Length: 1000 - EnableCoverageContinuationBooleanThis option allows you to enable dependent care coverage continuation for DCA plan types.

False (default) – Dependent care continuation is disabled on the plan.

True – Dependent care continuation is enabled on the plan

Note: If a ‘true’ value is submitted, and the plan type is not a DCA plan, or if dependent care coverage continuation has not been enabled at the employer level, an error is returned.First Available Version: AddEmployerPlanRequest_2019_10 Default Values: FALSEMax Length: 1 - AutoOffsetBalanceDueBooleanIf plan is set up to allow claims crossover autopay, this field specifies whether claims will autopay when a balance due exists on the account.

False (default) - Auto offset will not be enabled for the plan

True – Auto offset will be enabled for the planFirst Available Version: AddEmployerPlanRequest_2020_02 Default Values: FALSEMax Length: 1 - PreTaxLimitStringIndicates and sets the pretax limit available at the plan level to determine pre-tax amount and post-tax amounts for the claim’s approved amounts.

First Available Version: AddEmployerPlanRequest_2021_02 Max Length: 19 - EnableTaxYearDeadlineBooleanEnable deadline for claims to apply to current tax year vs. next tax year

0 - No (default)

1 - YesFirst Available Version: AddEmployerPlanRequest_2021_02 Default Values: FALSEMax Length: 1 - TaxYearDeadlineDateTimeDeadline must be between the plan start and end date.

Claims with a date on or before the deadline are assigned to the current tax year.

Claims with a date after the deadline are assigned to the next tax year.First Available Version: AddEmployerPlanRequest_2021_02 Max Length: 8 - TaxationCutoffDateTypeshortIndicates which date type is used to determine whether a claim is before or after the tax year deadline

0 - None

1 - DateOfService

2 - ReimbursementDateFirst Available Version: AddEmployerPlanRequest_2021_02 Max Length: 1 - EnablePreventElectionReductionBooleanField is ignored unless life event management is enabled.

False (Sets Do you want to prevent election reductions? to ‘no’) - default

True (Sets Do you want to prevent election reductions? to ‘yes’)First Available Version: AddEmployerPlanRequest_2021_11 - DeductibleCustomDescriptionStringAllows you to provide a custom description which displays when the deductible is not met on an account.

First Available Version: AddEmployerPlanRequest_2023_03 Max Length: 75 - EnableCarryoverString

First Available Version: AddEmployerPlanRequest_2023_10 - SpendingLimitPeriod_2023_10String

First Available Version: AddEmployerPlanRequest_2023_10 - TransactionLimitTypeString

First Available Version: AddEmployerPlanRequest_2023_10 - SpendingLimitTypeString

First Available Version: AddEmployerPlanRequest_2023_10 - CarryoverTemplateString

First Available Version: AddEmployerPlanRequest_2024_03

Response Message: Empty Message

Example of an AddEmployerPlan SOAP request message

<?xml version="1.0" encoding="utf-8" ?>

<soap:Envelope xmlns:soap="http://schemas.xmlsoap.org/soap/envelope/" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" xmlns:xsd="http://www.w3.org/2001/XMLSchema">

<soap:Header>

<MBISessionHeader xmlns="http://www.medibank.com/MBIWebServices/SoapHeader/">

<MBISessionID>kkhhjnze5fuaxz45fkwama55</MBISessionID>

</MBISessionHeader>

</soap:Header>

<soap:Body>

<GetEmployerBankAccount

xmlns="http://www.medibank.com/MBIWebServices/Employer/Messages/EmployerPlan/Request/2006/05/">

<addEmployerPlanRequest_2006_05>

<TpaId>T00202</TpaId>

<EmployerId>CYNCYN</EmployerId>

<PlanId>CYNP2</PlanId>

<AccountTypeCode>ACO</AccountTypeCode>

<PlanYearStartDate>2004-01-01</PlanYearStartDate>

<PlanYearEndDate>2004-12-31</PlanYearEndDate>

<GracePeriodEndDate>2004-12-31</GracePeriodEndDate>

<SpendingLimitPeriod xmlns="http://www.medibank.com/MBIWebServices/Enums/">None</SpendingLimitPeriod>

<SpendingDepositAmount>0</SpendingDepositAmount>

<SpendingTransactionAmount>0</SpendingTransactionAmount>

<PayCycleTypeCode xmlns="http://www.medibank.com/MBIWebServices/Enums/">NoAutoDeposit</PayCycleTypeCode>

<ConvenienceFeePayor xmlns="http://www.medibank.com/MBIWebServices/Enums/">None</ConvenienceFeePayor>

<ConvenienceFeeAmount>0</ConvenienceFeeAmount>

<MaxTransactionAmount>0</MaxTransactionAmount>

<MaxTotalAmount>0</MaxTotalAmount>

<DefaultPlanOptions xmlns="http://www.medibank.com/MBIWebServices/Enums/">None</DefaultPlanOptions>

</addEmployerPlanRequest_2006_05>

</GetEmployerBankAccount>

</soap:Body>

</soap:Envelope>

Example of an AddEmployerPlan SOAP response message

<?xml version="1.0" encoding="utf-8" ?>

<soap:Envelope xmlns:soap="http://schemas.xmlsoap.org/soap/envelope/"

xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance"

xmlns:xsd="http://www.w3.org/2001/XMLSchema">

<soap:Header>

<MBIMessageIdHeader xmlns="http://www.medibank.com/MBIWebServices/SoapHeader/" />

</soap:Header>

<soap:Body>

<AddEmployerPlanResponse xmlns="http://www.medibank.com/MBIWebServices/Employer/Messages/EmployerPlan/Response/2004/06/">

<AddEmployerPlanResult />

</AddEmployerPlanResponse>

</soap:Body>

</soap:Envelope>

Example Client Code

The following is an example of the client code (using a .NET proxy class for

accessing the service) used when calling the AddEmployerPlan web method.

try

{

// Create the session SOAP header in order to pass the Service

// the client’s current session id.

mbiSessionHeader = new EmployerPlanServiceNameSpace.MBISessionHeader();

// Create proxy object for the service

proxy = new EmployerPlanServiceNameSpace.EmployerPlanService();

// Create request message for method call (input parameters)

request = new EmployerPlanServiceNameSpace.AddEmployerPlanRequest_2006_05();

// Set the input parameters

request.AccountTypeCode = _AccountTypeCode.Text;

request.AllowPartialManualTransaction = Convert.ToBoolean(_AllowPartialManualTransaction.Text);

request.AutoDepositBypass = Convert.ToBoolean(_AutoDepositBypass.Text);

request.ConvenienceFeeAmount = Convert.ToDecimal(_ConvenienceFeeAmount.Text);

request.ConvenienceFeePayor =

(EmployerPlanServiceNameSpace.ConvenienceFeePayor)Enum.Parse(typeof(EmployerPlanServiceNameSpace.ConvenienceFeePayor),_ConvenienceFeePayor.Text,true);

request.DefaultPlanOptions = (EmployerPlanServiceNameSpace.DefaultPlanOptions)Enum.Parse(typeof(EmployerPlanServiceNameSpace.DefaultPlanOptions),_DefaultPlanOptions.Text);

request.EmployerId = _EmployerId.Text;

if(_GracePeriodEndDate.Text.Length > 0)

{

request.GracePeriodEndDate = Convert.ToDateTime(_GracePeriodEndDate.Text);

}

request.MaxTotalAmount = Convert.ToDecimal(_MaxTotalAmount.Text);

request.MaxTransactionAmount = Convert.ToDecimal(_MaxTransactionAmount.Text);

request.PayCycleTypeCode = (EmployerPlanServiceNameSpace.PayCycleType)Enum.Parse(typeof(EmployerPlanServiceNameSpace.PayCycleType),_PayCycleTypeCode.Text,true);

request.PlanId = _PlanId.Text;

if(_PlanYearStartDate.Text.Length > 0)

{

request.PlanYearStartDate = Convert.ToDateTime(_PlanYearStartDate.Text);

}

if(_PlanYearEndDate.Text.Length > 0)

{

request.PlanYearEndDate = Convert.ToDateTime(_PlanYearEndDate.Text);

}

request.SpendingDepositAmount = Convert.ToDecimal(_SpendingDepositAmount.Text);

request.SpendingLimitPeriod = (EmployerPlanServiceNameSpace.IntervalType)Enum.Parse(typeof(EmployerPlanServiceNameSpace.IntervalType),_SpendingLimitPeriod.Text,true);

request.SpendingTransactionAmount = Convert.ToDecimal(_SpendingTransactionAmount.Text);

request.TpaId = _TpaId.Text;

// session ID returned from login method

mbiSessionHeader.MBISessionID = _sessionId.Text;

proxy.MBISessionHeaderValue = mbiSessionHeader;

// Call the method

response = proxy.AddEmployerPlan(request);

MessageBox.Show("Finished.");

}

catch(SoapException se)

{

// perform needed operations

}

catch(Exception ex)

{

// perform needed operations

}

UpdateEmployerPlan

This method is used to update information about an employer’s plan.

The UpdateEmployerPlan methods are listed below:

Request Messages:

- UpdateEmployerPlanReqeust_2024_03

- UpdateEmployerPlanReqeust_2023_10

- UpdateEmployerPlanReqeust_2023_03

- UpdateEmployerPlanReqeust_2021_11

- UpdateEmployerPlanReqeust_2021_02

- UpdateEmployerPlanReqeust_2020_02

- UpdateEmployerPlanReqeust_2019_10

- UpdateEmployerPlanReqeust_2019_03

- UpdateEmployerPlanReqeust_2012_10

- UpdateEmployerPlanReqeust_2012_06

- UpdateEmployerPlanReqeust_2011_04

- UpdateEmployerPlanReqeust_2010_10

- UpdateEmployerPlanReqeust_2010_04

- UpdateEmployerPlanReqeust_2009_04

- UpdateEmployerPlanReqeust_2008_07

- UpdateEmployerPlanReqeust_2007_12

- UpdateEmployerPlanReqeust_2006_05

- UpdateEmployerPlanRequest

- UpdateEmployerPlanResponse

UpdateEmployerPlan Request/Response Messages

The UpdateEmployerPlan method requires the following request and response messages (input and output data).

- UpdateEmployerPlanResponse_2024_03

- UpdateEmployerPlanResponse_2023_10

- UpdateEmployerPlanResponse_2023_03

- UpdateEmployerPlanResponse_2021_11

- UpdateEmployerPlanResponse_2021_02

- UpdateEmployerPlanResponse_2019_10

- UpdateEmployerPlanResponse_2019_06

- UpdateEmployerPlanResponse_2019_03

- UpdateEmployerPlanResponse_2012_10

- UpdateEmployerPlanResponse_2012_06

- UpdateEmployerPlanResponse_2011_04

- UpdateEmployerPlanResponse_2009_04

- UpdateEmployerPlanResponse_2008_07

- UpdateEmployerPlanResponse_2007_12

- UpdateEmployerPlanResponse_2006_05

- UpdateEmployerPlanResponse

Request Body

- TpaIdStringrequiredA unique identifer for your administrator instance, generated by WCA when the instance was first set up.

First Available Version: UpdateEmployerPlanRequest - EmployerIdStringrequiredUnique identifier for the employer. Note: When the employer was created, WealthCare Admin assigned the 3-character prefix; you assigned the remaining characters.

First Available Version: UpdateEmployerPlanRequest Max Length: 12 - PlanIdStringrequiredUnique Identifier to distinguish this plan from others within the administrator.

Could be a combination of Plan ID, Account type, Effective Date and Expire Date.First Available Version: UpdateEmployerPlanRequest Max Length: 18 - AccountTypeCodeStringrequiredThree character abbreviation that indicates the type of account (FSA, DCA, TRN, HRA, and so on).

First Available Version: UpdateEmployerPlanRequest - PlanYearStartDateDaterequired(YYYMMDD)Date that funds are available for services.

First Available Version: UpdateEmployerPlanRequest - PlanYearEndDateDaterequired(YYYMMDD)Date after which services are not eligible for payment, unless there is an extension in the field.

First Available Version: UpdateEmployerPlanRequest - GracePeriodEndDateDaterequiredDate the grace period ends for this account. After this date, a warning displays when transactions are applied to this account type. This field corresponds to the UI field: “Run Out Date”

First Available Version: UpdateEmployerPlanRequest - PlanYearExtendedEndDateDateDate the extended period for this account type ends. After this date, a warning displays when POS transactions are applied to this account type. This field corresponds to the UI field: “Grace Period” or “IRS Grace Period/Extension Date”

First Available Version: UpdateEmployerPlanRequest - SpendingLimitPeriodEnumerationDetermines if this account type uses spending limits. Spending limits restricts the amount of money that can be deposited into or withdrawn from an account on a monthly or yearly basis. Valid values are:

None

Month

Year

CarryoverFirst Available Version: UpdateEmployerPlanRequest Default Values: None - SpendingDepositAmountDecimalMaximum amount to be deposited, during the spending Limit period.

An error message is returned if the ‘carryover’ option is selected for spending limit period: Spending deposit amount cannot be set when spending limit period is set to carryover.First Available Version: UpdateEmployerPlanRequest Default Values: 0 - SpendingTransactionAmountDecimalMaximum amount to be withdrawn, during the spending limit period.

An error message is returned if ‘carryover’ is selected for spending limit period: Spending transaction amount cannot be set when spending limit period is set to carryover.First Available Version: UpdateEmployerPlanRequest Default Values: 0 - AllowPartialManualTransactionBooleanDetermine if this account type allows partial payments of Manual Transactions

0 - Deny Manual Transactions if the entire amount is not available.(Default)

1 - Pay what is left in account towards Manual TransactionsFirst Available Version: UpdateEmployerPlanRequest Default Values: FALSE - AutoDepositBypassBooleanCorresponds to the Hold Account Funding UI option in WCA.

Set this flag to True to discontinue any future scheduled auto deposits.

Set this flag to False to enable auto deposits and catching up on any missed auto deposits, even those that occurred while this flag was set to True.First Available Version: UpdateEmployerPlanRequest Default Values: FALSE - ConvenienceFeePayorEnumerationWho will pay the convenience fee:

None (use this if no fee applied)

Administrator

Employer

EmployeeFirst Available Version: UpdateEmployerPlanRequest Default Values: None - ConvenienceFeePayorDecimalConvenience amount charged for each POS transaction.

Only used if Employee is paying the fee.First Available Version: UpdateEmployerPlanRequest Default Values: 0Max Length: 10 - MaxTransactionAmountDecimalMaximum amount exchanged per transaction under the plan.

First Available Version: UpdateEmployerPlanRequest Default Values: 0Max Length: 10 - MaxTotalAmountDecimalMaximum amount to be paid out over the Account Type’s date range.

First Available Version: UpdateEmployerPlanRequest Default Values: 0Max Length: 10 - DefaultPlanOptionsShortSet this field if administrator wishes to use the default plan functionality:

0-None(Default)

1-Plan

2-MTC

This is a bit field, so a sum value should be send if the administrator wishes to use the combination of defaults. Ex: if the administrator wants to create a plan with plan design defaults and MTC defaults , they have to set this field as 3 (1 + 2). See the bit field guide for more information.First Available Version: UpdateEmployerPlanRequest Default Values: 0 - ProductPartnerAccountFeeShortAllows the Product Partner to determine whether the monthly fee charged per participant is discounted or whether you receive a commission.

1=Commission to administrator, agency, or company

2=Discount to participant

Note: Leave blank if this plan is not a Product Partner HSA.First Available Version: UpdateEmployerPlanRequest_2006_05 Default Values: 0 - ProductPartnerSetupFeeShortAllows the Product Partner to determine whether the setup fee charged per participant is discounted or whether you receive a commission.

1=Commission to administrator, agency, or company

2=Discount to participant

Note: Leave blank if this plan is not a Product Partner HSA.First Available Version: UpdateEmployerPlanRequest_2006_05 Default Values: 0 - ProductPartnerIssueCheckbooksBoolean

Determines whether a participant receives a checkbook.

0 = No

1 = Yes

Note: Leave blank if this plan is not a Product Partner HSA.First Available Version: UpdateEmployerPlanRequest_2006_05 Default Values: FALSE - ProductPartnerEmployerIdStringThis is an additional employer identifier defined by the product partner, if requred by them, or may otherwise be defined by the administrator. Can be used to store employer tax ID or some other value associated with the employer.

Note 1: Leave blank if the plan is not an HSA.

Note 2: This field is required for HSA type plans. If the product partner employer ID is not provided, the record will fail.First Available Version: UpdateEmployerPlanRequest_2006_05 - ProductPartnerAdministrator IdStringThe value in this field links the administrator with the product partner. The product partner provides this ID for the administrator.

Note 1: Leave blank if the plan is not an HSA.

Note 2: This field is required for HSA type plans. If the administrator ID is not provided, the record will fail because the product partner relationship will not be found.First Available Version: UpdateEmployerPlanRequest_2006_05 - ProductPartnerProductIdStringUnique identifier for the Product Partner.

Note 1: Leave blank if the plan is not an HSA.

Note 2: This field is required for HSA type Plans. If the Product Partner Employer ID is not provided, the record will failFirst Available Version: UpdateEmployerPlanRequest_2006_05 - IiasSettingsEnumerationIndicates if and how IIAS is used for this plan. Valid options are:

0 = IIAS disabled (Default)

1 = IIAS Enabled for HET

2 = IIAS and Specific healthcare amount

4= IIAS Walgreens

8 = IIAS SIGIS

By making this selection to enable IIAS, Iyou are agreeing to the terms and conditions of the IIAS terms of use.First Available Version: UpdateEmployerPlanRequest_2007_12 Max Length: 0 - IiasOptionsEnumerati onIf IIAS Enabled = 0, then send IIAS Options = 0

If IIAS Enabled = 1, then 0 indicates HET

If IIAS Enabled = 2, then send the following IIAS Options value of 1 = RX

Note: The IIAS Options field is used by the administrator when not using HET. Rx and OTC are the only supported options at this time.

The options are:

0 = No, Healthcare Specific(Default)

1 = RxFirst Available Version: UpdateEmployerPlanRequest_2007_12 - CoverageTierTypeIdStringCoverage tier ID that you want to be attached to this plan as the ID appears in WCA. This has to have already been created by admin before running this service. Leave blank if not using coverage tiers.

First Available Version: UpdateEmployerPlanRequest_2008_07 Max Length: 10 - DefaultCoverageTierIdStringDefault coverage tier type ID for the plan. Leave blank if not using coverage tiers.

First Available Version: UpdateEmployerPlanRequest_2008_07 Max Length: 10 - LifeEventCalculationMe thodsEnumHow life events will be calculated. Only required if life event management is enabled.

None

AnnualDisbursements

MaximumBenefitsFirst Available Version: UpdateEmployerPlanRequest_2008_07 Default Values: None - OtherDepositStringUsed for SpecialDeposits functionality. Determines which Other Deposit Subtype IDs will be used.

First Available Version: UpdateEmployerPlanRequest_2008_07 - ManualClaimPercentCoverageIntegerPercentage of claim amount that should be paid from the funds in the employee’s account attached to this plan. Plan “Allow Partial Manual Transactions” must be set to “Yes” in order to utilize this feature. Whole dollar amounts >= 0 and <= 100 are accepted. For example, 50 is allowed. The default value is 100%.

This setting cannot be used if the Deductible Rules feature is enabled for the plan as percentage based rules are definable in the deductible rule settings. Please see Manual Claim Processing Enhancements for more detailsFirst Available Version: UpdateEmployerPlanRequest_2008_07 Default Values: 100 - IndividualBalanceMaxDecimalThis amount indicates the maximum balance that is allowed for the Individual Amount within the participant’s account after funds have been rolled from another account into this account. The Fund Rollover amount will be limited such that the Individual amount balance after funds have rolled into this account does not exceed the Fund Rollover Individual Balance Max specified.

Only set for individual amount in an Individual/Family HRA account.First Available Version: UpdateEmployerPlanRequest_2008_07 Max Length: 19 - RolloverBalanceMaxDecimalThis amount indicates the maximum balance that is allowed in a Participant’s account after funds have been rolled from another account into this account. The Fund Rollover amount will be limited such that the balance after funds have rolled into this account does not exceed the Fund Rollover Balance Max specified.

For example, a participant’s balance is $600 in the target account and the Fund Rollover Balance Max is set to $1000. If the source fund has $750 of eligible funds to roll into this account, the rollover amount will be limited to $400 rather than rolling the full $750 so that the balance in the participant’s account to which funds are being rolled is $1000.

This amount is also used for the family amount in an Individual/Family HRA account and for the Interest Bearing feature in WCA.First Available Version: UpdateEmployerPlanRequest_2008_07 Max Length: 19 - DefaultDepositCalendarIdStringID of calendar to use as the participant auto deposit default calendar for this plan.

To use, enable “Multiple Payroll Calendars” feature at the administrator level and setup your calendars/IDs.First Available Version: UpdateEmployerPlanRequest_2008_07 Default Values: .“”Max Length: 50 - FixedEmployerFundingCale ndarIdStringCalendar ID provided sets the Fixed Employer Funding deposit cycle for all participants associated with the plan.

To use, enable “Fixed Employer Funding” feature at the administrator level.First Available Version: UpdateEmployerPlanRequest_2008_07 Max Length: 50 - FixedEmployerFundingAmountDoubleIf using a Fixed Employer Funding Calendar, then this amount is the amount to be deposited per pay period to the participant’s account.

If not using a Fixed Employer Funding Calendar, then this amount is the single deposit amount to be credited to an employee account after the account and card (for card enabled employers) are created.

Note: Deposits occur nightly following creation of account/card.

If this amount is altered mid-plan year and

The Plan is using a Fixed Employer Funding Calendar, the new amount is what will be deposited on the next deposit date.

The Plan is not using a Fixed Employer Funding Calendar, only newly created accounts receive the new deposit amount (no change to existing accounts).First Available Version: UpdateEmployerPlanRequest_2008_07 Default Values: -1Max Length: 19 - FixedEmployerFundingAmountIndividualDoubleFor HRX plans only. The individual amount per pay period funded by employers.

Note: There is no increase in contributions YTD for Individual amounts.First Available Version: UpdateEmployerPlanRequest_2008_07 Default Values: -1Max Length: 19 - PlanOptionsShortSet this field if the administrator wishes to use the default plan functionality.

None(Default) = 0

AuthorizedTransit = 1

LifeEventBalanceManagement = 2

EnableCoverageTiers = 4

EnableSpecialDeposit = 8

ManualClaimPercentCoverage = 16

EnableDeductible = 32

DefaultAcctCrossover = 64

ServiceCategory = 128

AcctWithDeductibleFlag = 256

AcctWithDeductibleManager = 512

AutoIssueCard = 1024

EnforceEmpeContributionLimit = 2048

EnableEnrollmentSetup = 4096

EnablePlanDivClsCalSetup = 8192

EnablePayrollFunded = 16384

This is a bit field, so a sum value should be sent if the administrator wishes to use the combination of defaults. Ex. if administrator wants to create a Plan with Plan design defaults and MTC defaults, they have to set this field as 3 (1 + 2). See the bit field guide for more information.First Available Version: UpdateEmployerPlanRequest_2008_07 Default Values: 0 - ExtDeductibleShortExternal Deductible Not Supported - 0

External Deductible Supported - 1First Available Version: UpdateEmployerPlanRequest_2009_04 - AllowClaimsCrossoverIntegerFlag to identify whether claim crossover is enabled (i.e., can claims auto-pay from the account) at the plan level or not

Not allow - 0

Allow - 1First Available Version: UpdateEmployerPlanRequest_2009_04 Default Values: 0 - ClaimsCrossoverParticipantDefaultIntegerIf plan is setup to allow claims cross over auto pay, this field specifies the default opt in value when assigning employees to benefit accounts.

0 = Opt Out (Default)

1 = Opt In

Note: When assigning employees to this benefit plan, the opt in value can be set during enrollment. The default is only used if the opt in value is not set during enrollment.First Available Version: UpdateEmployerPlanRequest_2009_04 Default Values: 0 - AnnualElectMinDecimalDetermines what the minimum annual election amount entered for the employee can be.

First Available Version: UpdateEmployerPlanRequest_2009_04 - AnnualElectMaxDecimalDetermines what the maximum annual election amount entered for the employee can be.

First Available Version: UpdateEmployerPlanRequest_2009_04 - EnforceEmployeeContributionLimitBooleanEnforce employee annual election. If this is set to true, then payroll contributions added manually (or using data exchange) will not increase the annual election. If a payroll calendar is linked to the plan, then the employee's per pay period amount will automatically adjust to keep the annual election the same.

First Available Version: UpdateEmployerPlanRequest_2009_04 Default Values: FALSE - TermEmpeRunOutDaysIntegerDetermines amount of runout days for terminated employees during a plan year.

First Available Version: UpdateEmployerPlanRequest_2010_04 Default Values: 0 - TrackingNumberStringTracking Number which is returned with the response. WCA does not use this field; it is intended to help you correlate requests/responses.

First Available Version: UpdateEmployerPlanRequest_2010_10 Default Values: Blank - AllowAutoReimbSettingsInt16Use this field to indicate whether or not the plan will allow auto pay provider reimbursements.

1 - do not allow auto pay provider reimbursements

2 - allow auto pay provider reimbursementsFirst Available Version: UpdateEmployerPlanRequest_2011_04 Default Values: 0 - AutoReimbParticipantDefaultInt16conditionally requiredThis field will specify a default account setting for participants enrolled in a plan using auto provider pay.

1 - do not allow auto pay provider reimbursements (default)

2 - allow auto pay provider reimbursementsFirst Available Version: UpdateEmployerPlanRequest_2011_04 Default Values: 0 - ReimburseAmountsAppliedToDeductibleAccountBooleanUse this field to indicate whether or not the plan will reimburse amounts applied to the deductible tracking plan type (DTR). If the account is setup to reimburse amounts applied to the DTR plan, the DTR plan must be a higher priority plan and the claim must be submitted using Service Category Codes (SCCs) to make sure the manual claim splits properly.

False = No, the plan will not allow reimbursement of the deductible applied amounts (Default)

True = Yes, the plan will allow reimbursement of the deductible applied amounts.First Available Version: UpdateEmployerPlanRequest_2011_04 Default Values: FALSE - MerchantSubstantiaonBooleanTrue – Enables Merchant Substantiation on the plan

False – Disabled Merchant Substantiation on the planFirst Available Version: UpdateEmployerPlanRequest_2012_06 Default Values: FALSE - CustomDescriptionStringThe custom description will display on the participant WealthCare Portal and will replace the WCA default plan description text.

First Available Version: UpdateEmployerPlanRequest_2012_10 Max Length: 75 - UpdatePlanDatesFlagbooleanIndicates whether an existing plan’s various plan dates should be updated or not.

0 (False) - do not update plan dates (default)

1 (True) - update plan dates

If 1 is specified, then New Start Date, New End Date, New IRS Grace Period End/Extension Date, and New Run Out Period End Date are required.

Plan start and end dates cannot be changed to exclude any existing transactions in the plan year.

If QLE’s are enabled for a plan, plan dates can only be updated if no benefit accounts exist for the plan.

If QLE’s are enabled for a plan and at least one benefit account exists for the plan, the only the grace period date may be changed.First Available Version: UpdateEmployerPlanRequest_2012_10 Default Values: 0 - NewPlanYearStartDatedateconditionally requiredThe value provided in this field will replace the plan’s existing Start Date if Update Plan Dates Flag = 1.

This field is required if Update Plan Dates Flag = 1.

The new start date must be before the end date, grace period date and run out date.First Available Version: UpdateEmployerPlanRequest_2012_10 Default Values: None - NewPlanYearEndDatedateconditionally requiredThe value provided in this field will replace the plan’s existing End Date if Update Plan Dates Flag = 1.

This field is required if Update Plan Dates Flag = 1.

The new end date must be after the start date. It can be equal to or occur before the grace period date and run out date.First Available Version: UpdateEmployerPlanRequest_2012_10 Default Values: None - NewGracePeriodEndDatedateconditionally requiredThe value provided in this field will replace the plan’s existing Run out End Date if Update Plan Dates Flag = 1.

This field is required if Update Plan Dates Flag = 1.

The new run out end date must be after the start date. It can be equal to or occur after the end date. It cannot be past more than 77 days after the end date.First Available Version: UpdateEmployerPlanRequest_2012_10 Default Values: None - NewPlanYearExtendedEndDatedateconditionally requiredThe value provided in this field will replace the plan’s existing Grace Period Date if Update Plan Dates Flag = 1.

This field is required if Update Plan Dates Flag = 1.

The run out date is equal to or can occur after the grace period date and there is no restriction as to how far out in the future it could be.First Available Version: UpdateEmployerPlanRequest_2012_10 Default Values: None - HidePlanFromParticipantBooleanThis setting dictates whether an account on this plan will show to the participant in WCP/WCM or if it will be returned on Participant API responses.

0 (false) - accounts on this plan will be shown in WCP/WCM and be returned on Participant API responses

1 (true) - accounts on this plan will not be shown in WCP/WCM and will not be returned on Participant API responsesFirst Available Version: UpdateEmployerPlanRequest_2013_06 Default Values: FALSE - TrustPlanIDStringID associated with external HSA investments.

First Available Version: UpdateEmployerPlanRequest_2015_06 - HraTypeEnumHRA type. Valid values are:

None

IndividualFamilyAmt

SingleFundHraFirst Available Version: UpdateEmployerPlanRequest_2016_06 - OnHoldTxnBooleanUse this field to determine whether the plan will allow on hold transactions.

0 (false) - plan will not allow on hold transactions

1 (true) - plan will allow on hold transactionsFirst Available Version: UpdateEmployerPlanRequest_2016_06 Default Values: TRUEMax Length: 1 - DisableQleAmountEditBooleanUse this field to determine whether the option to edit Amounts is disabled.

0 = False, ability to edit amount is enabled

1 = True, ability to edit amount is disabledFirst Available Version: UpdateEmployerPlanRequest_2016_06 Default Values: TRUEMax Length: 1 - ProrationScheduleIDStringBlank (default) = The plan does not support prorated employer funding.

Any valid proration schedule ID = Yes, the plan supports prorated employer funding with the specified schedule.

Note: If a proration schedule ID is submitted, the ‘Does the funding amount change based on age?’ and ‘Does the funding amount change with the number of dependents?’ fields must not be enabled.First Available Version: UpdateEmployerPlanRequest_2018_02 Max Length: 18 - AllowPartialPayrollDepositsBooleanIndicates whether deposits over the Employee’s Annual election amount will be partially accepted.

0 = No (default)

1= Yes

Note: To enable this option, the ‘enforce employee annual election’ must also be enabled on this plan.First Available Version: UpdateEmployerPlanRequest_2018_02 Default Values: 0Max Length: 1 - UserDefinedFieldStringStores the value of the user defined field created at the plan level.

First Available Version: UpdateEmployerPlanRequest_2018_06 Max Length: 50 - CarryoverLimitEnumWhen spending limit period is ‘3’ (carryover), the following values can be entered:

0 – None

1 – All

2 – Cap

4 – Percent

8 – Percent up to capFirst Available Version: UpdateEmployerPlanRequest_2019_03 Default Values: 0Max Length: 1 - Carryover minimumDecimalWhen spending limit period is ‘3’ (carryover), use this field to specify the minimum available balance amount needed to be eligible for carryover. Values must be 0 or greater.

First Available Version: UpdateEmployerPlanRequest_2019_03 Max Length: 19 - CarryoverCapDecimalSpecifies the cap when option ‘2’ or ‘8’ is entered for the carryover limit field.

Note: If carryover limit field is set to any other option than ‘2’ or ‘8’, anything included in this field returns an error.First Available Version: UpdateEmployerPlanRequest_2019_03 Max Length: 19 - CarryoverPercentIntegerSpecifies the percentage when option ‘4’ or ‘8’ is entered for the carryover limit field.

Note: If carryover limit field is set to any other option than ‘4’ or ‘8’, anything included in this field returns an error.First Available Version: UpdateEmployerPlanRequest_2019_03 Max Length: 19 - HideEmployerContributionBooleanHides employer contribution information in WealthCare Portal and WealthCare Mobile

0 (false) - employer contributions will not be hidden from participant

1 (true) - employer contributions will be hidden from participantFirst Available Version: UpdateEmployerPlanRequest_2019_06 Default Values: 0Max Length: 1 - HideDeductibleBooleanHides deductible status messaging in WealthCare Portal and WealthCare Mobile

0 (false) - deductible status messaging will be shown to participant

1 (true) - deductible status messaging will be hidden from participantFirst Available Version: UpdateEmployerPlanRequest_2019_06 Default Values: 0Max Length: 1 - PlanUsageDescriptionStringHelpful description of plan usage to appear in WCM.

First Available Version: UpdateEmployerPlanRequest_2019_06 Max Length: 1000 - EnableAccountDormancyBooleanDormancy means participants can receive deposits, but they will not be able to use the funds for claims or card transactions. If dormancy is enabled, service category codes and merchant category codes should not be assigned. By enabling this setting, balance labels on WCP/WCM, transaction denial codes, participant communications and reporting may be impacted.

0 (False) – No, do not enable dormancy (default)

1 (True) – Yes, enable dormancy

Note 1: If the plan is an HSA, VEBA, or card reimbursement (CRA) plan type and ‘1’ is passed to enable dormancy, the request will fail with an error. HSA and VEBA are not compatible with dormancy.

Note 2: Currently, web services do not support creation or update of subgroups.First Available Version: UpdateEmployerPlanRequest_2019_10 Default Values: FALSEMax Length: 1 - ShowCustomPlanDescriptionInCoveragePeriodsBooleanIf enabled, the custom plan description configured for each plan or subgroup will display within the coverage period details section of WCP.

0 (False) - not enabled (default)

1 (True) – enabled

Note: Currently, web services do not support creation or update of subgroups.First Available Version: UpdateEmployerPlanRequest_2019_10 Default Values: FALSEMax Length: 1 - PlanUsageDescriptionHTMLStringHelpful description of plan usage (in HTML format) to appear on WCP/WCM.

Note: If subgroup is provided on the record, setting will be applied to the specified subgroup. If subgroup is not provided on the record, setting will be applied to the base plan.First Available Version: UpdateEmployerPlanRequest_2019_10 Default Values: ""Max Length: 1000 - EnableCoverageContinuationBooleanThis option allows you to enable dependent care coverage continuation for DCA plan types.

0 (False) (default) – Dependent care continuation is disabled on the plan.

1 (True) – Dependent care continuation is enabled on the plan

Note: If a ‘true’ value is submitted, and the plan type is not a DCA plan, or if dependent care coverage continuation has not been enabled at the employer level, an error is returned.First Available Version: UpdateEmployerPlanRequest_2020_02 Default Values: FALSEMax Length: 1 - AutoOffsetBalanceDueBooleanIf plan is set up to allow claims crossover autopay, this field specifies whether claims will autopay when a balance due exists on the account.

0 (False) - balance due will not be automatically offset (default)

1 (True) – Enable auto balance due offset via FXFirst Available Version: UpdateEmployerPlanRequest_2020_02 Default Values: FALSEMax Length: 1 - PreTaxLimitStringIndicates and sets the pretax limit available at the plan level to determine pre-tax amount and post-tax amounts for the claim’s approved amounts.

First Available Version: UpdateEmployerPlanRequest_2021_02 Max Length: 19 - EnableTaxYearDeadlineBooleanEnable deadline for claims to apply to current tax year vs. next tax year?

0 (False)

1 (True)First Available Version: UpdateEmployerPlanRequest_2021_02 Default Values: FALSEMax Length: 1 - TaxYearDeadlineYYYYMMDeadline must be between the plan start and end date.

Claims with a date on or before the deadline are assigned to the current tax year.

Claims with a date after the deadline are assigned to the next tax year.First Available Version: UpdateEmployerPlanRequest_2021_02 Max Length: 8 - TaxYearDeadlineDateTypeShortIndicates which date type is used to determine whether a claim is before or after the tax year deadline

1 – Date of service

2 – Reimbursement dateFirst Available Version: UpdateEmployerPlanRequest_2021_02 Max Length: 1 - PlanStatusEnum1 – New

2 – Active

3 – Temp inactive

4 – Perm inactive

Note 1: Plans with status other than 'new' can't be updated to 'new' status.

Note 2: Perm inactive status can’t be updated to any other status.

Note 3: Status can’t be changed from ‘new’ to ‘active’.First Available Version: UpdateEmployerPlanRequest_2021_11 - EnablePreventElectionReductionBooleanField is ignored unless life event management is enabled.

0 - False (Sets Do you want to prevent election reductions? to ‘no’) - default

1 - True (Sets Do you want to prevent election reductions? to ‘yes’)First Available Version: UpdateEmployerPlanRequest_2021_11 - DeductibleCustomDescriptionStringAllows you to provide a custom description which displays when the deductible is not met on an account. This will be displayed to participants in WCP and WCM, replacing the custom description or plan description, when the participant's deductible is not met.

First Available Version: UpdateEmployerPlanRequest_2023_03 Max Length: 75 - EnableCarryoverString

First Available Version: UpdateEmployerPlanRequest_2023_10 - SpendingLimitPeriod_2023_10String

First Available Version: UpdateEmployerPlanRequest_2023_10 - TransactionLimitTypeString

First Available Version: UpdateEmployerPlanRequest_2023_10 - SpendingLimitTypeString

First Available Version: UpdateEmployerPlanRequest_2023_10 - CarryoverTemplateString

First Available Version: UpdateEmployerPlanRequest_2024_03

Response Message: Empty Message

Example of an UpdateEmployerPlan SOAP request message

<?xml version="1.0" encoding="utf-8" ?>

<soap:Envelope xmlns:soap="http://schemas.xmlsoap.org/soap/envelope/" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" xmlns:xsd="http://www.w3.org/2001/XMLSchema">

<soap:Header>

<MBISessionHeader xmlns="http://www.medibank.com/MBIWebServices/SoapHeader/">

<MBISessionID>kkhhjnze5fuaxz45fkwama55</MBISessionID>

</MBISessionHeader>

</soap:Header>

<soap:Body>

<UpdateEmployerPlan_2006_05

xmlns="http://www.medibank.com/MBIWebServices/Employer/Messages/EmployerPlan/Request/2006/05/">

<updateEmployerPlanRequest_2006_05>

<TpaId>T00202</TpaId>

<EmployerId>CYNCYN</EmployerId>

<PlanId>CYNP1</PlanId>

<AccountTypeCode>ACO</AccountTypeCode>

<PlanYearStartDate>2004-01-01</PlanYearStartDate>

<PlanYearEndDate>2004-12-31</PlanYearEndDate>

<GracePeriodEndDate>2004-12-31</GracePeriodEndDate>

<SpendingLimitPeriod xmlns="http://www.medibank.com/MBIWebServices/Enums/">None</SpendingLimitPeriod>

<SpendingDepositAmount>-1.0000</SpendingDepositAmount>

<SpendingTransactionAmount>-1.0000</SpendingTransactionAmount>

<PayCycleTypeCode xmlns="http://www.medibank.com/MBIWebServices/Enums/">NoAutoDeposit</PayCycleTypeCode>

<ConvenienceFeePayor xmlns="http://www.medibank.com/MBIWebServices/Enums/">None</ConvenienceFeePayor>

<ConvenienceFeeAmount>0</ConvenienceFeeAmount>

<MaxTransactionAmount>100.0000</MaxTransactionAmount>

<MaxTotalAmount>100.0000</MaxTotalAmount>

<DefaultPlanOptions xmlns="http://www.medibank.com/MBIWebServices/Enums/">None</DefaultPlanOptions>

</updateEmployerPlanRequest_2006_05>

</UpdateEmployerPlan_2006_05>

</soap:Body>

</soap:Envelope>

Example of an UpdateEmployerPlan SOAP response message

<?xml version="1.0" encoding="utf-8" ?>

<soap:Envelope xmlns:soap="http://schemas.xmlsoap.org/soap/envelope/" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" xmlns:xsd="http://www.w3.org/2001/XMLSchema">

<soap:Header>

<MBIMessageIdHeader xmlns="http://www.medibank.com/MBIWebServices/SoapHeader/" />

</soap:Header>

<soap:Body>

<UpdateEmployerPlanResponse xmlns="http://www.medibank.com/MBIWebServices/Employer/Messages/EmployerPlan/Response/2004/06/">

<UpdateEmployerPlanResult />

</UpdateEmployerPlanResponse>

</soap:Body>

</soap:Envelope>

Example Client Code

The following

is an example of the client code (using a .NET proxy class for accessing the

service) used when calling the UpdateEmployerPlan web method.

try

{

// Create the session SOAP header in order to pass the Service

// the client’s current session id.

mbiSessionHeader = new EmployerPlanServiceNameSpace.MBISessionHeader();

// Create proxy object for the service

proxy = new EmployerPlanServiceNameSpace.EmployerPlanService();

// Create request message for method call (input parameters)

request = new EmployerPlanServiceNameSpace.UpdateEmployerPlanRequest_2006_05();

// Set the input parameters

request.AccountTypeCode = _AccountTypeCode.Text;

request.AllowPartialManualTransaction = Convert.ToBoolean(_AllowPartialManualTransaction.Text);

request.AutoDepositBypass = Convert.ToBoolean(_AutoDepositBypass.Text);

request.ConvenienceFeeAmount = Convert.ToDecimal(_ConvenienceFeeAmount.Text);

request.ConvenienceFeePayor = (EmployerPlanServiceNameSpace.ConvenienceFeePayor)Enum.Parse(typeof(EmployerPlanServiceNameSpace.ConvenienceFeePayor),_ConvenienceFeePayor.Text,true);

request.DefaultPlanOptions = (EmployerPlanServiceNameSpace.DefaultPlanOptions)Enum.Parse(typeof(EmployerPlanServiceNameSpace.DefaultPlanOptions),_DefaultPlanOptions.Text);

request.EmployerId = _EmployerId.Text;

if(_GracePeriodEndDate.Text.Length > 0)

{

request.GracePeriodEndDate = Convert.ToDateTime(_GracePeriodEndDate.Text);

}

request.MaxTotalAmount = Convert.ToDecimal(_MaxTotalAmount.Text);

request.MaxTransactionAmount = Convert.ToDecimal(_MaxTransactionAmount.Text);

request.PayCycleTypeCode = (EmployerPlanServiceNameSpace.PayCycleType)Enum.Parse(typeof(EmployerPlanServiceNameSpace.PayCycleType),_PayCycleTypeCode.Text,true);

request.PlanId = _PlanId.Text;

if(_PlanYearEndDate.Text.Length > 0)

{

request.PlanYearEndDate = Convert.ToDateTime(_PlanYearEndDate.Text);

}

if(_PlanYearStartDate.Text.Length > 0)

{

request.PlanYearStartDate = Convert.ToDateTime(_PlanYearStartDate.Text);

}

request.SpendingDepositAmount = Convert.ToDecimal(_SpendingDepositAmount.Text);

request.SpendingLimitPeriod = (EmployerPlanServiceNameSpace.IntervalType)Enum.Parse(typeof(EmployerPlanServiceNameSpace.IntervalType),_SpendingLimitPeriod.Text,true);

request.SpendingTransactionAmount = Convert.ToDecimal(_SpendingTransactionAmount.Text);

request.TpaId = _TpaId.Text;

// session ID returned from login method

mbiSessionHeader.MBISessionID = _sessionId.Text;

proxy.MBISessionHeaderValue = mbiSessionHeader;

// Call the method

response = proxy.DeleteEmployerPlan(request);

MessageBox.Show("Finished.");

}

catch(SoapException se)

{

// perform needed operations

}

catch(Exception ex)

{

// perform needed operations

}

DeleteEmployerPlan

This method deletes an existing employer plan.

History

The DeleteEmployerPlan methods are listed below:

- DeleteEmployerPlanRequest

- DeleteEmployerPlanResponse

DeleteEmployerPlan Request/Response Messages

The DeleteEmployerPlan

method requires the following request and response messages (input and

output data).

The table below includes the following request messages:

• DeleteEmployerPlanRequest

Request Body

- TpaIdStringrequiredUnique identifier assigned to each administrator, created by WCA when the TPA was first configured.

First Available Version: DeleteEmployerPlanRequest - EmployerIdStringrequiredUnique identifier for the employer. Note: When the employer was created, WealthCare Admin assigned the 3-character prefix; you assigned the remaining characters.

First Available Version: DeleteEmployerPlanRequest Max Length: 12 - PlanIdStringrequiredUnique identifier to distinguish this plan from others within the administrator.

First Available Version: DeleteEmployerPlanRequest Max Length: 18 - AccountTypeCodeStringrequiredThree character abbreviation that indicates the type of account (FSA, DCA, TRN, HRA, etc..)

First Available Version: DeleteEmployerPlanRequest - PlanYearStartDateDaterequiredStart date associated with the plan.

First Available Version: DeleteEmployerPlanRequest - PlanYearEndDateDaterequiredEnd date associated with the plan.

First Available Version: DeleteEmployerPlanRequest

Example of a DeleteEmployerPlan SOAP request message

<?xml version="1.0" encoding="utf-8" ?>

<soap:Envelope xmlns:soap="http://schemas.xmlsoap.org/soap/envelope/" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" xmlns:xsd="http://www.w3.org/2001/XMLSchema">

<soap:Header>

<MBISessionHeader xmlns="http://www.medibank.com/MBIWebServices/SoapHeader/">

<MBISessionID>kkhhjnze5fuaxz45fkwama55</MBISessionID>

</MBISessionHeader>

</soap:Header>

<soap:Body>

<DeleteEmployerPlan xmlns="http://www.medibank.com/MBIWebServices/Employer/Messages/EmployerPlan/Request/2004/06/">

<deleteEmployerPlanRequest_2006_05>

<TpaId>T00202</TpaId>

<EmployerId>CYNCYN</EmployerId>

<PlanId>CYNP1</PlanId>

<AccountTypeCode>ACO</AccountTypeCode>

<PlanYearStartDate>2004-01-01</PlanYearStartDate>

<PlanYearEndDate>2004-12-31</PlanYearEndDate>

</deleteEmployerPlanRequest_2006_05>

</DeleteEmployerPlan>

</soap:Body>

</soap:Envelope>

Example of a DeleteEmployer SOAP response message

<?xml version="1.0" encoding="utf-8" ?>

<soap:Envelope xmlns:soap="http://schemas.xmlsoap.org/soap/envelope/" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" xmlns:xsd="http://www.w3.org/2001/XMLSchema">

<soap:Header>

<MBIMessageIdHeader xmlns="http://www.medibank.com/MBIWebServices/SoapHeader/" />

</soap:Header>

<soap:Body>

<DeleteEmployerPlanResponse xmlns="http://www.medibank.com/MBIWebServices/Employer/Messages/EmployerPlan/Response/2004/06/">

<DeleteEmployerPlanResult />

</DeleteEmployerPlanResponse>

</soap:Body>

</soap:Envelope>

Example Client Code

The following

is an example of the client code (using a .NET proxy class for accessing the

service) used when calling the DeleteEmployerPlan web method.

try

{

// Create the session SOAP header in order to pass the Service

// the client’s current session id.

mbiSessionHeader = new EmployerPlanServiceNameSpace.MBISessionHeader();

// Create proxy object for the service

proxy = new EmployerPlanServiceNameSpace.EmployerPlanService();

// Create request message for method call (input parameters)