The transaction service provides clients transactional functionalities such as deposits, claims, and viewing transaction history.

Important note: In order to facilitate backward compatibility with all web services in use prior to June 4, 2005, either employee (dependent), social security number, or employee (dependent) ID may be provided when required to uniquely identify an employee or dependent. If both are provided, the employee (dependent) ID is used as the unique identifier.

Note: Every method on the transaction service has been converted to the Windows Communication Foundation architecture. To make use of the technology, the following URL should be used:

https://www.mbiwebservices.com/MBIWebServices/Transactions/Services/TransactionService.svc

The following is a list of methods that is provided by the transaction service.

- DepositPayroll – used to deposit funds to an employee’s benefit account.

- DepositPrefunded – used to deposit funds to an employee’s benefit account.

- GetTransactionHistory – used to view past POS transactions for an employee.

- GetTransactionDetails – used to view details for a given transaction.

- SubmitManualClaim – used to process manual claims (non-POS claims).

- SubmitManualRefund – used to process manual claims (non-POS claims).

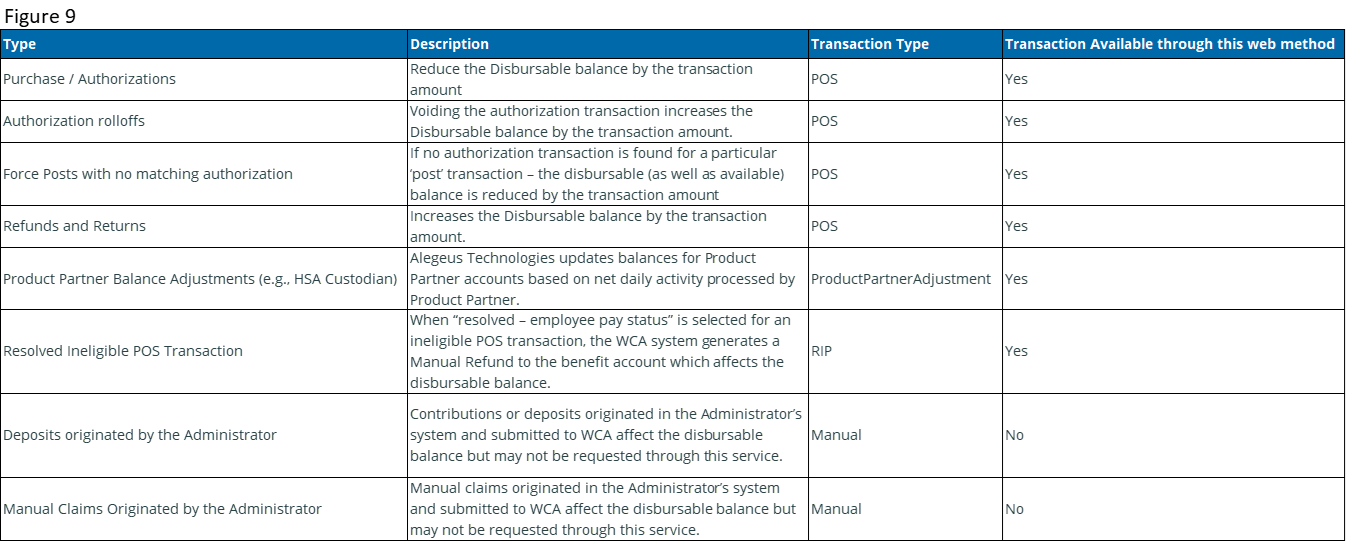

- GetDisbursableBalanceAffectingTxns - This method is used to retrieve a list of transactions that result in updating disbursable balance on the account within the last 30 days

- GetDisbursableBalanceAffectingTotal - This method is used to retrieve a total amount of balance affecting transactions (as defined above) for the day.

- OtherDeposit – This method is used to do a special / other deposit to an employee’s benefit account. This is an employer deposit made to employee’s account like incentives or interest.

- GetRecentTransactions – This method is used to retrieve a listing of up to the ten most recent transactions for a specific employee or dependent.

- GetTransactionbyTN - This method is used to retrieve transaction information using the tracking number as the identifier

- SubmitParticipantClaim - This method is used to submit a claim for a participant

- SubmitDocument - This method is used to attach a document, such as a receipt, to a participant's transaction

- SubmitParticipantClaimDocument - This method is used to attach a document, such as a receipt, to a participant's claim

The transaction service makes the following assumptions as well as enforce the following business rules.

- Clients shall conform to the WS-I specifications unless otherwise agreed upon by Alegeus and the administrator.

- Clients shall format SOAP messages in a Document/Literal format over HTTPS.

- Clients shall have already created a valid user ID and password.

- Clients shall have a valid session ID after being authenticated by the system. The session ID needs to be passed in the proper manner as described in the Account Manager Service Guide.

- If the administrator uses the same user ID and password for all of their clients, the administrator is responsible for managing the security of the data.

- Clients should validate data before submitting a request to this Service. This facilitates better performance and accurate processing on both systems.

- Clients shall not attempt to use this service for batch processing of large amounts of data. The service is designed for synchronous calls that send or retrieve small chunks of data. If batch processing is required, then the EDI process should be used.

- If any method fails, the service returns a SOAP fault describing the problem.

This method is used to deposit funds to an employee’s benefit account by way of a payroll deposit. Negative deposit amounts (adjustments) could be applied using this method, lowering the employee’s benefit account balance.

- Set account type, account type start date, and account type end date to describe the account in which to make the deposit for an employee.

- WCA does not check for duplicate employee deposits. It is the responsibility of the calling application not to send duplicate employee deposits

History

The DepositPayroll methods are listed below:

- DepositPayrollRequest_2010_04

- DepositPayrollRequest_2006_05

- DepositPayrollRequest

- DepositPayrollResponse

DepositPayroll Request/Response Messages

The DepositPayroll

method requires the following request and response messages (input and

output data).

- DepositPayrollRequest_2010_04

- DepositPayrollRequest_2006_05

- DepositPayrollRequest

Request Body

- AccountTypeCodeStringrequiredThree character abbreviation that indicates the type of account (FSA, DCA, TRN, HRA, etc.)

First Available Version: DepositPayrollRequest - AccountTypeEndDateString (YYYYMMDD)requiredPlan year end date for the account the deposit should process against

First Available Version: DepositPayrollRequest - AccountTypeStartDateString (YYYYMMDD)requiredPlan year start date for the account the deposit should process against

First Available Version: DepositPayrollRequest - DisplayDateDateTimeDate displayed to the employer/employee. Default to today’s date unless date is listed. If DisplayDate is not passed and the plan is future or past then use plan start and end date respectively.

First Available Version: DepositPayrollRequest Default Values: Today's date - DisplayToCardholderBooleanIndicates if the deposit should be displayed to the participant

0 (false) - will not display to cardholder

1 (true) - will display to cardholderFirst Available Version: DepositPayrollRequest Default Values: TRUE - EmployeeDepositAmountDecimalrequiredEnter the amount to be added to the employee’s account by the employee (0.00 is a valid entry).

First Available Version: DepositPayrollRequest - EmployeeSocialSecurityNumberStringconditionally requiredEmployee’s social security number. Required if this field is being used as the unique identifier for the participant. Either this or EmployeeId may be used for this purpose.

First Available Version: DepositPayrollRequest - EmployeeIdStringconditionally requiredEmployee ID, a unique identifer for the participant. Required if this field is being used as the unique employee identifier. Either this field or EmployeeSocialSecurityNumber may be used for this purpose.

First Available Version: DepositPayrollRequest - EmployerDepositAmountDecimalrequiredEnter the amount to be added to the employee’s account by the employer (0.00 is a valid entry).

First Available Version: DepositPayrollRequest - EmployerIdStringrequiredUnique identifier for the employer. Note: When the employer was created, WealthCare Admin assigned the 3-character prefix; you assigned the remaining characters.

First Available Version: DepositPayrollRequest Max Length: 12 - NoteStringOptional note to be attached to this transaction.

First Available Version: DepositPayrollRequest Max Length: 255 - TpaIdStringA unique identifer for your administrator instance, generated by WCA when the instance was first set up. If a value is not sent, the TPA ID from the user making the request with be used.

First Available Version: DepositPayrollRequest - PlanIdStringUnique identifier that distinguishes this plan from all others you administer.

First Available Version: DepositPayrollRequest_2006_05 Max Length: 18 - EnforceParticipantEligDateBooleanIndicates if the participant eligibity date should be enforced for this deposit.

0 (False) = No. WCA does not enforce Participant Eligibility Dates.

1 (True) = Yes. The Service Start Date and Service End Dates must be within the Employee and/or Dependent’s eligibility and termination dates.

Note 1: If Enforce Eligibility Dates is not included in the template, the eligibility dates are not enforced.

Note 2: If the Eligibility Date is sent on the record and the Employee does not have Eligibility Date in the system, the Eligibility Dates will be ignored.First Available Version: DepositPayrollRequest_2010_04 Default Values: FALSE - EnforceAccountEffDateBooleanIndicates if the participant effective date should be enforced for this deposit.

0 (False) = No. WCA does not enforce Effective Dates

1 (True) = Yes. The Service Start Date and Service End Dates must be within the Employee and/or Dependent’s account effective and termination dates.

Note: If this field is not in the II record template, the employee account effective dates will not be checked. If this field is in the II template, and a value of 1 is passed or the field is left blank, then WCA will enforce that the service date of the claim falls within the participant’s effective period for the benefit plan.

Note 2: Enforcing Account Effective Dates will also validate that the claim is submitted prior to the “Last Day to Submit Claims” for a participant. The last date to submit claims is calculated using the plan Run Out Date, Employee Termination Date, Account Termination Date and the Run Out Days for Terminating Employees specified on the benefit plan.First Available Version: DepositPayrollRequest_2010_04 Default Values: FALSE - TrackingNumberStringTracking Number for the deposit

First Available Version: DepositPayrollRequest_2010_04 - FlexAcctIdStringA uniue identifer for the account, generated by WCA when the account was created.

First Available Version: DepositPayrollRequest_2010_04

Response Message: Empty Message

Example of a DepositPayroll SOAP request message:

<s:Envelope xmlns:s="http://schemas.xmlsoap.org/soap/envelope/">

<s:Header>

<mbiSessionHeader xmlns:i="http://www.w3.org/2001/XMLSchema-instance">

<MBISessionID

xmlns="http://schemas.datacontract.org/2004/07/MBI.WebServices.Wcf.Headers">xuzwemv54lkupaujy4s sfnqa</MBISessionID> </mbiSessionHeader>

</s:Header>

<s:Body>

<DepositPayroll

xmlns="http://bensoft.metavante.com/WebServices/Contracts/Transaction/2009/04/V1">

<depositPayrollRequest

xmlns:d4p1="http://bensoft.metavante.com/WebServices/Messages/Transaction/Request/2004/06/" xmlns:i="http://www.w3.org/2001/XMLSchema-instance"

xmlns:d4p3="http://bensoft.metavante.com/WebServices/Messages/Transaction/Request/2006/05/" i:type="d4p3:DepositPayroll_2006_05">

<d4p1:AccountTypeCode>FSA</d4p1:AccountTypeCode>

<d4p1:AccountTypeEndDate>20091231</d4p1:AccountTypeEndDate>

<d4p1:AccountTypeStartDate>20090101</d4p1:AccountTypeStartDate>

<d4p1:DisplayDate>2009-04-07T10:44:00</d4p1:DisplayDate>

<d4p1:DisplayToCardholder>false</d4p1:DisplayToCardholder>

<d4p1:EmployeeDepositAmount>0</d4p1:EmployeeDepositAmount>

<d4p1:EmployeeId>Employee1</d4p1:EmployeeId>

<d4p1:EmployeeSocialSecurityNumber>333333333</d4p1:EmployeeSocialSecurityNumber>

<d4p1:EmployerDepositAmount>0</d4p1:EmployerDepositAmount>

<d4p1:EmployerId>WWW123</d4p1:EmployerId>

<d4p1:Note>Notes</d4p1:Note>

<d4p1:TpaId>T00111</d4p1:TpaId>

<d4p3:PlanId>FSA1</d4p3:PlanId>

</depositPayrollRequest>

</DepositPayroll>

</s:Body>

</s:Envelope>

Example of a DepositPayroll SOAP response message:

<s:Envelope xmlns:s="http://schemas.xmlsoap.org/soap/envelope/">

<s:Header />

<s:Body>

<DepositPayrollResponse

xmlns="http://bensoft.metavante.com/WebServices/Contracts/Transaction/2009/04/V1">

<DepositPayrollResult i:type="b:DepositPayrollResponse_2006_05"

xmlns:a="http://bensoft.metavante.com/WebServices/Messages/Transaction/Response/2004/06/" xmlns:i="http://www.w3.org/2001/XMLSchema-instance"

xmlns:b="http://bensoft.metavante.com/WebServices/Messages/Transaction/Response/2006/05/" /> </DepositPayrollResponse>

</s:Body>

</s:Envelope>

Example client code

The following is an example of the client code

(using a .NET proxy class for accessing the service) used when submitting a

deposit to the DepositPayroll web method:

try

{

// create new SOAP header for the user’s current session id

localhost.MBISessionHeader sh = new localhost.MBISessionHeader();

// create the proxy object for the service

localhost.TransactionService proxy = new localhost.TransactionService();

// create a new request object for the method’s parameters

localhost.DepositPayrollRequest_2006_05 request = new

localhost.DepositPayrollRequest_2006_05();

// set the parameters for the web method call

request.AccountTypeCode = "DCA";

request.AccountTypeEndDate = "20031231";

request.AccountTypeStartDate = "20030101";

request.DisplayDate = new DateTime(2004,3,16);

request.DisplayToCardholder = true;

request.EmployeeDepositAmount = 100;

request.EmployeeSocialSecurityNumber = "333333333";

request.EmployerDepositAmount = 54.54M;

request.EmployerId = "BCBOOOOOO";

request.Note = "This is a test";

request.TpaId = "TPA123";

// Add the session SOAP header so that the service knows who we are.

// Note that we stored the session ID in a member variable after

// logged in to the system for future web method calls.

sh.MBISessionID = _sessionID;

proxy.MBISessionHeaderValue = sh;

// Call the web method.

proxy.DepositPayroll(request);

MessageBox.Show("Finished");

}

catch(SoapException se)

{

// perform needed operations

}

catch(Exception ex)

{

// perform needed operations

}

This method is used to deposit funds to an employee’s benefit account by way of prefunded deposits. Below are some points of interest about the method.

-

Pre-funded deposits are adjustments to the pre-funded amount.

- Example 1: An employee has $1000 in their FSA and wished to increase that amount to $1500. A $500 pre-funded deposit must be made.

- Example 2: An employee is supposed to have $800 in their FSA but the account incorrectly lists $1000. A pre-funded deposit for -$200 must be made.

- Set account type, account type start date, and account type end date to describe the account in which to make the deposit for an employee.

- WCA does not check for duplicate employee prefunded deposits. It is the responsibility of the calling application not to send duplicate requests.

History

The DepositPrefunded methods are listed below:

- DepositPrefundedRequest_2010_04

- DepositPrefundedRequest_2008_07

- DepositPrefundedRequest_2006_12

- DepositPrefundedRequest_2006_05

- DepositPrefundedRequest

- DepositPrefundedResponse

DepositPrefunded Request/Response Messages

The DepositPrefunded

method requires the following request and response messages (input and

output data).

The table below includes the following request messages:

- DepositPrefundedRequest_2010_04

- DepositPrefundedRequest_2008_07

- DepositPrefundedRequest_2006_12

- DepositPrefundedRequest_2006_05

- DepositPrefundedRequest

Request Body

- AccountTypeCodeStringrequiredThree character abbreviation that indicates the type of account (FSA, DCA, TRN, HRA, etc.)

First Available Version: DepositPrefundedRequest - AccountTypeEndDateString (YYYYMMDD)requiredPlan year end date for the account the deposit should process against

First Available Version: DepositPrefundedRequest - AccountTypeStartDateString (YYYYMMDD)requiredPlan year start date for the account the deposit should process against

First Available Version: DepositPrefundedRequest - DisplayDateDateTimeDate displayed to the employer/employee. Default to Today’s date unless date is listed. If DisplayDate is not passed and the plan is future or past then use plan start and end date respectively.

First Available Version: DepositPrefundedRequest Default Values: 1900-01-01 - DisplayToCardholderBooleanIndicates if the deposit should be displayed to the participant

0 (false) - will not display to cardholder

1 (true) - will display to cardholderFirst Available Version: DepositPrefundedRequest Default Values: TRUE - EmployeeIdStringconditionally requiredEmployee ID, a unique identifer for the participant. Required if this field is being used as the unique employee identifier. Either this field or EmployeeSocialSecurityNumber may be used for this purpose.

First Available Version: DepositPrefundedRequest Max Length: 30 - EmployeeSocialSecurityNumberStringconditionally requiredEmployee’s social security number. Required if this field is being used as the unique identifier for the participant. Either this or EmployeeId may be used for this purpose.

First Available Version: DepositPrefundedRequest Max Length: 9 - EmployerIdStringrequiredUnique identifier for the employer. Note: When the employer was created, WealthCare Admin assigned the 3-character prefix; you assigned the remaining characters.

First Available Version: DepositPrefundedRequest Max Length: 12 - NoteStringOptional note to be attached to this transaction.

First Available Version: DepositPrefundedRequest Max Length: 255 - PrefundedAdjustmentAmountDecimalrequiredThe amount by which the prefunded account adjusted.

First Available Version: DepositPrefundedRequest - TpaIdStringA unique identifer for your administrator instance, generated by WCA when the instance was first set up. If a value is not sent, the TPA ID from the user making the request with be used.

First Available Version: DepositPrefundedRequest - PlanIdStringUnique identifier that distinguishes this plan from all others you administer.

First Available Version: DepositPrefundedRequest_2006_05 Max Length: 18 - HraDepositTypeEnumerationIndicates if the deposit should go towards the family or individual accumulator.

FamilyAmountPrefund = 3,

IndividualAmountPrefund = 4First Available Version: DepositPrefundedRequest_2006_05 Default Values: IndividualAmountPrefund - FamilyMemberIdStringFamily member to whom funds need to be deposited.

First Available Version: DepositPrefundedRequest_2006_05 Default Values: ‘’ - OverrideAmountFlagBooleanBefore using this field, contact us. This field adjusts the pre-funded employee or individual amounts.

0 (false) = No. Add the amount specified to the current pre-funded amount.

1 (true) = Yes. Overwrite the existing prefunded amount with this value.First Available Version: DepositPrefundedRequest_2006_12 Default Values: FALSE - OverrideSuspendActivityBoolean0 (False) If not overriding a qualified event in a Suspended status

1 (True) If overriding a qualified event that is in Suspended status.First Available Version: DepositPrefundedRequest_2008_07 Default Values: FALSE - CoveragePeriodDateDateTimeYYYY-MM-DD. Enter the coverage period date for this deposit, if using qualified life events.

First Available Version: DepositPrefundedRequest_2008_07 - EnforceParticipantEligibilityDateBooleanIndicates if the participant eligibity date should be enforced for this deposit.

0 (False) = No. WCA does not enforce Participant Eligibility Dates.

1 (True) = Yes. The Service Start Date and Service End Dates must be within the Employee and/or Dependent’s eligibility and termination dates.

Note 1: If Enforce Eligibility Dates is not included in the template, the eligibility dates are not enforced.

Note 2: If the Eligibility Date is sent on the record and the Employee does not have Eligibility Date in the system, the Eligibility Dates will be ignored.First Available Version: DepositPrefundedRequest Default Values: FALSE - EnforceAccountEffectiveDateBooleanIndicates if the participant effective date should be enforced for this deposit.

0 (False) = No. WCA does not enforce Effective Dates

1 (True) = Yes. The Service Start Date and Service End Dates must be within the Employee and/or Dependent’s account effective and termination dates.

Note: If this field is not in the II record template, the employee account effective dates will not be checked. If this field is in the II template, and a value of 1 is passed or the field is left blank, then WCA will enforce that the service date of the claim falls within the participant’s effective period for the benefit plan.

Note 2: Enforcing Account Effective Dates will also validate that the claim is submitted prior to the “Last Day to Submit Claims” for a participant. The last date to submit claims is calculated using the plan Run Out Date, Employee Termination Date, Account Termination Date and the Run Out Days for Terminating Employees specified on the benefit plan.First Available Version: DepositPrefundedRequest Default Values: FALSE - TrackingNumberStringYou can assign and use a number to identify specific claims. Note: WCA does not use this number.

First Available Version: DepositPrefundedRequest_2010_04 - FlexAcctIdStringA uniue identifer for the account, generated by WCA when the account was created.

First Available Version: DepositPrefundedRequest_2010_04 - HideFromReportsBooleanIndicates if the deposit should be included on WCA reports.

0 (False) - Display transaction in reports

1 (True) – Hide transaction from reportsFirst Available Version: DepositPrefundedRequest Default Values: FALSE - ClaimReceivedDateDateTimeThe date the claim was received by the administrator

First Available Version: DepositPrefundedRequest

Response Message: Empty Message

Example of a DepositPrefunded SOAP request message:

<s:Envelope xmlns:s="http://schemas.xmlsoap.org/soap/envelope/">

<s:Header>

<mbiSessionHeader xmlns:i="http://www.w3.org/2001/XMLSchema-instance">

<MBISessionID

xmlns="http://schemas.datacontract.org/2004/07/MBI.WebServices.Wcf.Headers">xuzwemv54lkupaujy4s sfnqa</MBISessionID> </mbiSessionHeader>

</s:Header>

<s:Body>

<DepositPrefunded

xmlns="http://bensoft.metavante.com/WebServices/Contracts/Transaction/2009/04/V1">

<depositPrefundedRequest

xmlns:d4p1="http://bensoft.metavante.com/WebServices/Messages/Transaction/Request/2004/06/" xmlns:i="http://www.w3.org/2001/XMLSchema-instance"

xmlns:d4p3="http://bensoft.metavante.com/WebServices/Messages/Transaction/Request/2008/07/" i:type="d4p3:DepositPrefunded_2008_07">

<d4p1:AccountTypeCode>FSA</d4p1:AccountTypeCode>

<d4p1:AccountTypeEndDate>20091231</d4p1:AccountTypeEndDate>

<d4p1:AccountTypeStartDate>20090101</d4p1:AccountTypeStartDate>

<d4p1:DisplayDate>2009-04-07T10:49:00</d4p1:DisplayDate>

<d4p1:DisplayToCardholder>false</d4p1:DisplayToCardholder>

<d4p1:EmployeeId>Employee</d4p1:EmployeeId>

<d4p1:EmployeeSocialSecurityNumber>333333333</d4p1:EmployeeSocialSecurityNumber>

<d4p1:EmployerId>www133</d4p1:EmployerId>

<d4p1:Note>Notes</d4p1:Note>

<d4p1:PrefundedAdjustmentAmount>0</d4p1:PrefundedAdjustmentAmount>

<d4p1:TpaId>T00111</d4p1:TpaId>

<FamilyMemberId

xmlns="http://bensoft.metavante.com/WebServices/Messages/Transaction/Request/2006/05/">FF</Famil yMemberId>

<HraDepositType

xmlns="http://bensoft.metavante.com/WebServices/Messages/Transaction/Request/2006/05/">FamilyAm ountPrefund</HraDepositType>

<PlanId i:nil="true"

xmlns="http://bensoft.metavante.com/WebServices/Messages/Transaction/Request/2006/05/" />

<OverrideAmountFlag

xmlns="http://bensoft.metavante.com/WebServices/Messages/Transaction/Request/2006/12/">false</Ov errideAmountFlag>

<d4p3:CoveragePeriodDate>2009-04-07T10:48:00</d4p3:CoveragePeriodDate>

<d4p3:OverrideSuspendActivity>false</d4p3:OverrideSuspendActivity>

</depositPrefundedRequest>

</DepositPrefunded>

</s:Body>

</s:Envelope>

Example of a DepositPrefunded SOAP response message:

<s:Envelope xmlns:s="http://schemas.xmlsoap.org/soap/envelope/">

<s:Header />

<s:Body>

<DepositPrefundedResponse

xmlns="http://bensoft.metavante.com/WebServices/Contracts/Transaction/2009/04/V1">

<DepositPrefundedResult

xmlns:a="http://bensoft.metavante.com/WebServices/Messages/Transaction/Response/2004/06/" xmlns:i="http://www.w3.org/2001/XMLSchema-instance" />

</DepositPrefundedResponse>

</s:Body>

</s:Envelope>

Example client code

The following is an example of the client code

(using a .NET proxy class to connect with the service) used when submitting

an amount to the DepositPrefunded method:

try

{

// create new SOAP header for the user’s current session id

localhost.MBISessionHeader sh = new localhost.MBISessionHeader();

// create the proxy object for the service

localhost.TransactionService proxy = new localhost.TransactionService();

// create a new request object for the method’s parameters

localhost.DepositPrefundedRequest_2006_12 request =

new localhost.DepositPrefundedRequest_2006_12();

// set the parameters for the web method call

request.AccountTypeCode = "ORT";

request.AccountTypeEndDate = "20041231";

request.AccountTypeStartDate = "20040101";

request.DisplayDate = new DateTime(2004,3,16);

request.DisplayToCardholder = true;

request.EmployeeSocialSecurityNumber = "333333333";

request.PrefundedAdjustmentAmount = 54.54M;

request.EmployerId = "BCBOOOOOO";

request.Note = "This is a test";

request.TpaId = "TPA123";

request.OverrideAmountFlag = false;

// Add the session SOAP header so that the service knows who we are.

// Note that we stored the session ID in a member variable after

// logged in to the system for future web method calls. sh.MBISessionID = _sessionID;

proxy.MBISessionHeaderValue = sh;

// Call the web method.

proxy.DepositPrefunded(request);

MessageBox.Show("Finished");

}

catch(SoapException se)

{

// perform needed operations

}

catch(Exception ex)

{

// perform needed operations

}

GetTransactionHistory

This method

is used to retrieve transactional information for an employee’s benefit

account.

History

The GetTransactionHistory methods are listed below:

- GetTransactionHistory_2011_10

- GetTransactionHistory_2010_10

- GetTransactionHistory_2007_12

- GetTransactionHistoryRequest_2006_05

- GetTransactionHistoryRequest

- GetTransactionHistoryResponse_2013_02

- GetTransactionHistoryResponse_2012_10

- GetTransactionHistoryResponse_2012_03

- GetTransactionHistoryResponse_2010_10

- GetTransactionHistoryResponse_2008_07

- GetTransactionHistoryResponse_2007_12

- GetTransactionHistoryResponse_2006_05

- GetTransactionHistoryResponse

GetTransactionHistory Request/Response Messages

The

GetTransactionHistory method requires the following request and response

messages (input and output data).

- GetTransactionHistoryRequest_2010_10

- GetTransactionHistoryRequest_2007_12

- GetTransactionHistoryRequest_2006_05

- GetTransactionHistoryRequest

Request Body

- AccountTypeCodeStringThree character abbreviation that indicates the type of account for which to return transactions for (FSA, DCA, TRN, HRA, etc.)

First Available Version: GetTransactionHistoryRequest - AccountTypeEndDateString (YYYYMMDD)If sent, only transactions against an account with a plan year end date of this date will be returned.

First Available Version: GetTransactionHistoryRequest - AccountTypeStartDateString (YYYYMMDD)If sent, only transactions against an account with a plan year start date of this date will be returned.

First Available Version: GetTransactionHistoryRequest - CardNumberStringconditionally requiredBenefit card number. You must provide either the card number, card proxy number, cardholder social security number, or cardholder ID; all are not required. If either or both cardholder identifiers (SSN or ID) are provided in addition to card number (or proxy number), card number (or proxy number) is used.

First Available Version: GetTransactionHistoryRequest - CardProxyNumberStringconditionally requiredAlternative benefit debit card number. See CardNumber description for conditional requirements.

First Available Version: GetTransactionHistoryRequest_2013_02 - DateOfServiceFromDateIf sent, only transactions with a service start date after this date will be returned.

First Available Version: GetTransactionHistoryRequest - DateOfServiceToDateIf sent, only transactions with a service start date before this date will be returned.

First Available Version: GetTransactionHistoryRequest - CardholderIdStringconditionally requiredReplaced by Employee/Dependent ID fields in version 2011_10. You must provide either the card number, card proxy number, cardholder social security number, or cardholder ID; all are not required. If either or both cardholder identifiers (SSN or ID) are provided in addition to card number (or proxy number), card number (or proxy number) is used.

First Available Version: GetTransactionHistoryRequest Max Length: 30 - CardholderSocialSecurityNumberStringconditionally requiredReplaced by Employee/Dependent SSN fields in version 2011_10. I61

First Available Version: GetTransactionHistoryRequest Max Length: 9 - EmployerIdStringrequiredUnique identifier for the employer. Note: When the employer was created, WealthCare Admin assigned the 3-character prefix; you assigned the remaining characters.

First Available Version: GetTransactionHistoryRequest Max Length: 12 - TransactionStatusEnumerationrequiredThis can be used as a filter to only return transactions in a specified status. Valid statuses are:

Approved

Ineligible

Pending

ReslovedEmployeePay

ResolvedPayrollDeduction

New

Denied

Unknown

ResolvedNoRefund

IneligiblePartiallyOffset

ResolvedOffsetbyManualClaim

UnauthorizedRefund

InsufficientDocumentation

Overpayment

AllFirst Available Version: GetTransactionHistoryRequest Default Values: All - TransactionTypeEnumerationrequiredThis can be used as a filter to only return transactions of a specified type. Valid types are:

Deposit

POS

Manual

All

OtherDepositFirst Available Version: GetTransactionHistoryRequest Default Values: Deposit - TpaIdStringA unique identifer for your administrator instance, generated by WCA when the instance was first set up. If a value is not sent, the TPA ID from the user making the request with be used.

First Available Version: GetTransactionHistoryRequest - VerboseModeBooleanOptional, if set to true, the method may return more details as to why a query did not return any records.

First Available Version: GetTransactionHistoryRequest Default Values: FALSE - PlanIdStringUnique identifier that distinguishes this plan from all others you administer.

First Available Version: GetTransactionHistoryRequest_2006_5 Max Length: 18 - QueryIiasBooleanSet this field to true to see values on the IIAS specific fields that are on the response.

First Available Version: GetTransactionHistoryRequest_2007_12 Default Values: FALSE - DepositsEnteredByEnumerationUse this field to export Deposits entered by admin only, employer only or all

Admin

Employer

AllFirst Available Version: GetTransactionHistoryRequest_2010_10 Default Values: Admin - EmployeeIdStringconditionally requiredEmployee ID, a unique identifer for the employee. You must provide either the card number, card proxy number, cardholder social security number, or cardholder ID; all are not required. If either or both cardholder identifiers (SSN or ID) are provided in addition to card number (or proxy number), card number (or proxy number) is used.

First Available Version: GetTransactionHistoryRequest_2011_10 Max Length: 30 - EmployeeSocialSecurityNumberStringconditionally requiredSocial security number for the employee. You must provide either the card number, card proxy number, cardholder social security number, or cardholder ID; all are not required. If either or both cardholder identifiers (SSN or ID) are provided in addition to card number (or proxy number), card number (or proxy number) is used.

First Available Version: GetTransactionHistoryRequest_2011_10 Max Length: 9 - DependentIdStringA unique identifer for a dependent. Either this or DependentSocialSecurityNumber may be used to identify a dependent for which you wish to retrieve transactions for.

First Available Version: GetTranactionHistoryRequest_2011_10 Max Length: 30 - DependentSocialSecurityNumberStringSocial security number for a dependent. Either this or DependentSocialSecurityNumber may be used to identify a dependent for which you wish to retrieve transactions for.

First Available Version: GetTranactionHistoryRequest_2011_10 Max Length: 9 - WCHSATransactionShortIndicates if HSA transactions should be included on the response.

0 – Include - sends both HSA and non-HSA transactions in the response

1 - Only - only HSA transactions will be returned on the response

2 - Exclude - only non-HSA transactions will be returned on the responseFirst Available Version: GetTranactionHistoryRequest_2011_02 Default Values: 0Max Length: 1

- GetTransactionHistoryResponse_2012_10

- GetTransactionHistoryResponse_2012_03

- GetTransactionHistoryResponse_2010_10

- GetTransactionHistoryResponse_2008_07

- GetTransactionHistoryResponse_2007_12

- GetTransactionHistoryResponse_2006_05

- GetTransactionHistoryResponse

Response Body

- AccountTypeCodeStringThree character abbreviation that indicates the type of account (FSA, DCA, TRN, HRA, etc.)

First Available Version: GetTransactionHistoryResponse - AccountTypeEndDateString (YYYYMMDD)Plan year end date for the account the transaction processed against

First Available Version: GetTransactionHistoryResponse - AccountTypeStartDateString (YYYYMMDD)Plan year start date for the account the transaction processed against

First Available Version: GetTransactionHistoryResponse - CardholderIdStringThe employee ID or dependent ID that the transaction is for. The ID is a unique identifier for that person.

First Available Version: GetTransactionHistoryResponse - CardholderSocialSecurityNumberStringThe social security number for either the employee or dependent, depending on who the transaction processed for

First Available Version: GetTransactionHistoryResponse - CardNumberStringThe card number that the transaction was processed with.

Note: This field is only returned if it was used in the request.First Available Version: GetTransactionHistoryResponse - DateOfServiceFromDateBeginning Date of Services for the transaction. The actual date that the cardholder had the service provided.

First Available Version: GetTransactionHistoryResponse - DateOfServiceToDateEnding Date of Services for the transaction. The actual date that the cardholder had the service provided.

First Available Version: GetTransactionHistoryResponse - DisplayDateDateTimeDate displayed to the employer/employee. Default to Today’s date unless date is listed.

First Available Version: GetTransactionHistoryResponse - DisplayToCardholderBooleanDetermines if the transaction will be displayed to the cardholder via WCP/WCM or Participant APIs.

0 (False) = No, transaction will not display to the cardholder

1 (True) = Yes, transaction will display to the cardholder

Defaults to true (Yes).First Available Version: GetTransactionHistoryResponse - EmpeAvailBalDecimalAvailable Balance is the Disbursable Balance plus the Auth Hold Balance.

If this account has multiple QLE Coverage Periods, this field will contain the current coverage period’s balance.

Note: For full-featured HRAs—HRX, HX1 …HX6—with family and individual amounts, this amount is the individual balance for the employee or dependent.First Available Version: GetTransactionHistoryResponse - EmpeDisbBalDecimalDisbursable Balance = Available Balance minus Auth Hold Balance.

If this account has multiple QLE Coverage Periods, this field will contain the current coverage period’s balance.

Note : For full-featured HRAs—HRX, HX1 …HX6—with family and individual amounts, this amount is the individual balance for the employee or dependent.First Available Version: GetTransactionHistoryResponse - EmpeDisbPtdDecimalEmployee’s disbursable paid to date, at the time of the transaction

First Available Version: GetTransactionHistoryResponse - EmpePreauthBalDecimalEmployee’s pre-auth balance at the time of the transaction

First Available Version: GetTransactionHistoryResponse - MerchantNameStringThe name of the merchant as received from the terminal. Note: This field is truncated at 22 characters.

First Available Version: GetTransactionHistoryResponse - MerchantTypeCodeStringAlso referred to as Merchant Category Code. Indicates the type of merchant submitting the transaction. The identifier is encoded into the terminal by the issuing bank and transmitted with every transaction.

Note: If the transaction was accepted because of a terminal, merchant, or employee exception, the code is considered a converted MTC. The code is designated as MCC for MasterCard and SIC for Visa.First Available Version: GetTransactionHistoryResponse - NoteStringAny notes that are on the transaction

First Available Version: GetTransactionHistoryResponse - SequenceNumberIntegerWCA assigns a sequence number within the settlement date for every transaction that it receives. Using the settlement date and the settlement sequence number is a way to uniquely identify a transaction within the system.

First Available Version: GetTransactionHistoryResponse - SettlementDateString (YYYYMMDD)Date that the transactions was settled on. Settlement occurs typically at 3:45 PM CT so all transactions received that day before that time and all transactions received after 3:45 PM CT the previous day have the same settlement date.

First Available Version: GetTransactionHistoryResponse - StatusCodeStringA code used to provide more detail about the transaction. Refer to the Transaction Status Code table for more information.

First Available Version: GetTransactionHistoryResponse - TrackingNumberStringThis can be used as an identifier for the transaction. Note: WCA does not use this number.

First Available Version: GetTransactionHistoryResponse - TransactionAdjudicationStatusEnumerationAdjudication status of the transction. Possible values include:

1 = Approved

2 = Ineligible

3 = Pending

4 = ResolvedEmployeePay

5 = ResolvedPayrollDeduction

6 = New

7 = Denied

8 = Unknown

9 = ResolvedNoRefund

10 = IneligiblePartiallyOffset

11 = ResolvedOffsetbyManualClaim

13 = InsufficientDocumentation

14 = EnteredNotReviewed

15 = Reversed

16 = ClaimReversal

17 = Overpayment

18 = OverpaymentPartiallyResolved

19 = OverpaymentResolved

20 = Nonpost

21 = Returned

22 = ResubmittedFirst Available Version: GetTransactionHistoryResponse - TransactionAmountDecimalThe transaction amount.

First Available Version: GetTransactionHistoryResponse - TransactionDateDateTimeDate of the transaction.

First Available Version: GetTransactionHistoryResponse - TransactionDeniedAmountDecimalDenied transaction amount.

First Available Version: GetTransactionHistoryResponse - TxnAdjudDescStringDescription for the transaction adjudication.

First Available Version: GetTransactionHistoryResponse - TransactionCodeEnumerationTransaction Code

0 = Unassigned

11 = Purchase

12 = PreAuth

13 = ForcePost

14 = Refund

20 = EmployerDeposit

21 = PrefundedDeposit

22= AutoDeposit

23 = Adjustment

24 = Void

25 = PrefundedDepositReset

26 = BalanceSyncAdjustment

27 = IndividualAmt

28 = IndividualAmtReset

29 = HsaImported

30 = OtherDeposit

31 = RolloverDeposit

32 = FamilyRolloverDeposit

33 = FamilyOther DepositFirst Available Version: GetTransactionHistoryResponse_2006_05 - TotalAuthorizedAmountOriginalDecimalTotal amount of this transaction.

Note: If this amount is more than the amount in the Transaction Amount field, this transaction has been split.First Available Version: GetTransactionHistoryResponse_2007_12 - HetAmountOriginalDecimalThe Healthcare Eligible Total (HET) requested/provided by the merchant.

First Available Version: GetTransactionHistoryResponse_2007_12 - HetAmountDecimalThe HET amount applied to the account for this transaction.

Note: If an administrator has selected the OTC amount on which to authorize IIAS transactions, the HET amount authorized field will be populated as well. This is because IIAS merchants do not transmit an OTC amount (OTC is a calculated amount done in WealthCare Admin) and Alegeus simply returns the OTC amount authorized back to the IIAS merchant in the HET amount authorized fieldFirst Available Version: GetTransactionHistoryResponse_2007_12 - RxAmountOriginalDecimalFor an IIAS transaction, this will be the original prescription amount. Will be 0 if not populated.

First Available Version: GetTransactionHistoryResponse_2007_12 - RxAmountDecimalFor an IIAS transaction, this will be the prescription amount approved. Will be 0 if not populated.

First Available Version: GetTransactionHistoryResponse_2007_12 - DentalAmountOriginalDecimalFor an IIAS transaction, this will be the original dental amount. Will be 0 if not populated.

First Available Version: GetTransactionHistoryResponse_2007_12 - DentalAmountDecimalFor an IIAS transaction, this will be the dental amount approved. Will be 0 if not populated.

First Available Version: GetTransactionHistoryResponse_2007_12 - VisionAmountOriginalDecimalFor an IIAS transaction, this will be the original vision amount. Will be 0 if not populated.

First Available Version: GetTransactionHistoryResponse_2007_12 - VisionAmountDecimalFor an IIAS transaction, this will be the vision amount approved. Will be 0 if not populated.

First Available Version: GetTransactionHistoryResponse_2007_12 - PartialAuthIndicatorBooleanIndicator received from a merchant, indicating if partial authorization is allowed.

0 (False)

1 (True)First Available Version: GetTransactionHistoryResponse_2007_12 - PartialAuthorizedBooleanIndicates if the transaction was partially authorized

0 (False)

1 (True)First Available Version: GetTransactionHistoryResponse_2007_12 - ErrorCodeStringError code and description indicating why a transaction was not approved. If the transaction was successful, "0 - Approved" will be returned.

First Available Version: GetTransactionHistoryResponse_2007_12 - TpsErrorCodeIntegerReal time adjudication code. If the transaction is IIAS (Inventory Information Approval System) adjudicated, this has a 12 and 0 for real-time PBM(Pharmacy Benefits Management).

First Available Version: GetTransactionHistoryResponse_2007_12 - OffsetAmountDecimalDollar amount that was offset from a manual claim.

First Available Version: GetTransactionHistoryResponse_2007_12 - DepositSubTypeIdStringDeposit Sub Type ID. No value will be sent if there is not a deposit subtype for the transaction.

First Available Version: GetTransactionHistoryResponse_2008_07 - TransactionDescStringA description indicating what type of transaction this is

First Available Version: GetTransactionHistoryResponse_2008_07 - DeductibleAmountDecimalAmount of this claim that was applied to the deductible on this account.

First Available Version: GetTransactionHistoryResponse_2008_07 - BypassDeductibleIndicatorBoolean0 (False) – Do not bypass (apply toward deductible as appropriate)

1 (True) – Bypass Deductible (claim not applicable to the deductible and was eligible to be paid) Indicates whether this transaction used deductible rules when it was applied to the account or if it was paid out directly (was not applicable to the deductible).First Available Version: GetTransactionHistoryResponse_2008_07 - ReduceByBalanceMaxBooleanFor rollover deposits, indicates if the amount rolled over was reduced due to the balance of the account meeting or exceeding the maximum balance.

First Available Version: GetTransactionHistoryResponse_2008_07 - FundRolloverTypeShort0= Non-rollover transaction

1 = Primary Fund Rollover

2 = Secondary Fund Rollover (FUTURE)First Available Version: GetTransactionHistoryResponse_2008_07 - RolloverDepositsPtdDecimalDeposits made Year to Date INTO this account via Fund Rollover. For an Individual/Family HRA plan, this is the Individual Fund information– If a Dependent ID is provided, then this is the Dependent’s individual Fund information.

First Available Version: GetTransactionHistoryResponse_2008_07 - FamilyRolloverDepositsPtdDecimalIndividual/Family HRA plans only. Deposits made Year to Date INTO this account via Fund Rollover.

First Available Version: GetTransactionHistoryResponse_2008_07 - ServiceCategoryCodeStringService category code that the transaction was processed with

First Available Version: GetTransactionHistoryResponse_2008_07 - ServiceCategoryCodeDescriptionStringThe description for the service category code that the transaction was processed with

First Available Version: GetTransactionHistoryResponse_2008_07 - ManualClaimNumberStringA system generated number assigned to a manual claim once that claim is successfully submitted. Consists of YYYYMMDD + INCREMENT, where INCREMENT is a sequential number. For example, if the first claim of the day was submitted on 19 March 2008, then the # would be 200803191.

Note; Both the tracking number and Manual claim number appear on the latest version (July, 2008) of the Manual Claim Denial Letter.First Available Version: GetTransactionHistoryResponse_2008_07 - EligibleAmtDecimalWCA calculated as the Administrator submitted Approved Amount less the WCA determined Excluded Amount, This value is the amount of the claim that is eligible for payment and shown on the Transaction History screen.

First Available Version: GetTransactionHistoryResponse_2008_07 - ExcludedAmountDecimalOn a manual claim only, amount the system has deemed ineligible based on pre-configured business rules set up in the system by the administrator (example: amount excluded due to participant ineligible on service dates)

First Available Version: GetTransactionHistoryResponse_2008_07 - ExcludedErrorCodeIntegerCode indicating the “excluded amount” was deducted from payment

First Available Version: GetTransactionHistoryResponse_2008_07 - ExcludedErrorDescriptionStringDescription corresponding to ExcludedErrorCode, explaining why the "excluded amount" was deducted from the payment

First Available Version: GetTransactionHistoryResponse_2008_07 - LowFundAmountDecimalBoth manual and POS claims. The amount in excess of the account balance at the time of the Transaction. Low Funds Amount = Original transaction amount - denied amount – excluded amount – amount applied to deductible – ineligible offset amount.

First Available Version: GetTransactionHistoryResponse_2008_07 - TermDteStringDate upon which the employee is no longer eligible for benefits

First Available Version: GetTransactionHistoryResponse_2010_10 - EligDteStringDate upon which the employee is no longer eligible for benefits. This existing field is being updated to validate that it is after the eligibility date.

First Available Version: GetTransactionHistoryResponse_2010_10 - TransactionPendedAmountDecimalThis will return the pended amount value for a manual claim.

First Available Version: GetTransactionHistoryResponse_2010_10 - FlexAcctIdStringA uniue identifer for the account, generated by WCA when the account was created.

First Available Version: GetTransactionHistoryResponse_2010_10 - PayProviderFlagStringIndicates whether the transaction was reimbursed to a provider or directly to the participant.

0 -Participant Reimbursed Claim

1 -Provider Reimbursed ClaimsFirst Available Version: GetTransactionHistoryResponse_2010_10 - ProviderAddress1StringAddress line 1 associated with the provider’s mailing address

First Available Version: GetTransactionHistoryResponse_2010_10 - ProviderAddress1StringAddress line 2 associated with the provider’s mailing address

First Available Version: GetTransactionHistoryResponse_2010_10 - ProviderCityStringCity associated with the provider’s mailing address

First Available Version: GetTransactionHistoryResponse_2010_10 - ProviderIDStringIdentifier for the Provider, as entered into WCA when the provider was created. Required if PayProviderFlag is true.

First Available Version: GetTransactionHistoryResponse_2010_10 - ProviderStateString

State associated with the provider’s mailing addressFirst Available Version: GetTransactionHistoryResponse_2010_10 - ProviderZipString

Zip Code associated with the provider’s mailing addressFirst Available Version: GetTransactionHistoryResponse_2010_10 - CheckClearedDteString (YYYYMMDD)The date the transaction’s check cleared the source of funds bank account. The check cleared date may be entered by the administrator via the UI, or using EDI on the (FB) import record.

First Available Version: GetTransactionHistoryResponse_2012_03 - ExternalClaimNumberStringExternal Claim Number added to transactions to facilitate and track overpayments

First Available Version: GetTransactionHistoryResponse_2012_10 - PINNetworkIndicatorBoolean0 (False) Signature Based

1 (True) PIN Based

Will indicate whether the transaction is a PIN based or signature based transaction.First Available Version: GetTransactionHistoryResponse_2013_02 - ExcludeFromEmployerFundingBooleanAllows administrators to exclude the transactions from WCA Employer Funding calculations.

0 (False) – Include in Employer Funding (Default)

1 (True) – Exclude from EmployerFundingFirst Available Version: GetTransactionHistoryResponse_2013_06 - TransactionCodeStringCode to identify the type of transaction.

11 = Purchase

12 = PreAuth

13 = ForcePost

14 = Refund

20 = EmployerDeposit

21 = PrefundedDeposit

22= AutoDeposit

23 = Adjustment

24 = Void

25 = PrefundedDepositReset

26 = BalanceSyncAdjustment

27 = IndividualAmt

28 = IndividualAmtReset

29 = HsaImported

30 = OtherDeposit

31 = RolloverDeposit

32 = FamilyRolloverDeposit

33 = FamilyOther DepositFirst Available Version: GetTransactionHistoryResponse_2013_06 - HSAPostingDateStringPosting date, for HSA transactions only

First Available Version: GetTransactionHistoryResponse_2013_06 - HSACodeDescriptionStringThe human-friendly description for the IRS reporting category associated with the HSA account transaction, derived from the transaction type or the product partner HSA Status Code. For HSA transactions only.

First Available Version: GetTransactionHistoryResponse_2013_06 - HSACodeIntThe numeric code for the IRS reporting category associated with the HSA account transaction, derived from the transaction type or the product partner HSA Status Code. For HSA transactions only.

First Available Version: GetTransactionHistoryResponse_2013_06 - HSAReasonForNonPostDescriptionStringHSA Reason For Non-Post Description

First Available Version: GetTransactionHistoryResponse_2013_06 - HSAReasonForNonPostCodeIntWhen an HSA transaction is in a status of non-post, this field will include a human friendly description indicating why it was a non-post. This field orresponds with HSAReasonForNonPostCode. For HSA transactions only.

First Available Version: GetTransactionHistoryResponse_2013_06 - PostingTypeStringIndicates the type of transaction

Credit

Debit

BothFirst Available Version: GetTransactionHistoryResponse_2013_06 - GLAccountStringThe name of the general ledger account used for settlement. For HSA transactions only.

First Available Version: GetTransactionHistoryResponse_2013_06 - HoldAmountDecimalThe total amount in holds on the account

First Available Version: GetTransactionHistoryResponse_2013_06

GetTransactionDetails

This is used to retrieve detail about a transaction.

History

The GetTransactionDetails methods are listed below:

- GetTransactionDetailsRequest_2013_02

- GetTransactionDetailsRequest_2012_10

- GetTransactionDetailsRequest_2007_12

- GetTransactionDetailsRequest

- GetTransactionDetailsResponse_2021_02

- GetTransactionDetailsResponse_2016_06

- GetTransactionDetailsResponse_2015_02

- GetTransactionDetailsResponse_2013_06

- GetTransactionDetailsResponse_2013_02

- GetTransactionDetailsResponse_2012_10

- GetTransactionDetailsResponse_2012_03

- GetTransactionDetailsResponse_2010_10

- GetTransactionDetailsResponse_2010_04

- GetTransactionDetailsResponse_2009_04

- GetTransactionDetailsResponse_2008_07

- GetTransactionDetailsResponse_2007_12

- GetTransactionDetailsResponse

GetTransactionDetails Request/Response Messages

The

GetTransactionDetails method requires the following request and response

messages (input and output data).

- GetTransactionDetailsRequest_2013_02

- GetTransactionDetailsRequest_2012_10

- GetTransactionDetailsRequest_2007_12

- GetTransactionDetailsRequest

Request Body

- SettlementDateString (YYYYMMDD)requiredDate the transactions settled on. Used with SettlementSequenceNumber to uniquely identify a transaction.

Settlement occurs typically at 3:45 PM CT, so all transactions received that day before that time and all transactions received after 3:45 PM CT the previous day have the same settlement date.First Available Version: GetTransactionDetailsRequest Default Values: ""Max Length: 8 - SettlementSequenceNumberIntegerrequiredWCA assigns a sequence number within the settlement date for every transaction that it receives. Using the settlement date and the settlement sequence number is a way to uniquely identify a transaction within the system.

First Available Version: GetTransactionDetailsRequest Default Values: -1 - TpaIdStringA unique identifer for your administrator instance, generated by WCA when the instance was first set up. The API will use the TPA ID associated with the username making the call if not sent.

First Available Version: GetTransactionDetailsRequest - VerboseModeBooleanOptional, if set to true, the method may return more details as to why a query did not return any records.

First Available Version: GetTransactionDetailsRequest Default Values: FALSE - QueryIiasBooleanTo see IIAS related data on the response, set this field to true.

First Available Version: GetTransactionDetailsRequest_2007_12 Default Values: FALSE - ExternalClaimNumberStringExternal claim number

First Available Version: GetTransactionDetailsRequest_2012_10 Default Values: ""Max Length: 30 - CardProxyStringProxy card number for the employee or dependent.

First Available Version: GetTransactionDetailsRequest_2013_02 Default Values: ""

- GetTransactionDetailsResponse_2021_02

- GetTransactionDetailsResponse_2016_06

- GetTransactionDetailsResponse_2015_02

- GetTransactionDetailsResponse_2013_06

- GetTransactionDetailsResponse_2013_02

- GetTransactionDetailsResponse_2012_10

- GetTransactionDetailsResponse_2012_03

- GetTransactionDetailsResponse_2010_10

- GetTransactionDetailsResponse_2010_04

- GetTransactionDetailsResponse_2009_04

- GetTransactionDetailsResponse_2008_07

- GetTransactionDetailsResponse_2007_12

- GetTransactionDetailsResponse

Response Body

- AccountTypeCodeStringThree character abbreviation that indicates the type of account (FSA, DCA, TRN, HRA, etc.) that the transaction was processed against.

First Available Version: GetTransactionDetailsResponse - ApprovalCodeStringUnique code assigned by MasterCard/Visa or the authorization process to identify this transaction.

First Available Version: GetTransactionDetailsResponse - BalanceAfterTransactionDecimalThe account's available balance after the transaction has processed, less any holds on the account

First Available Version: GetTransactionDetailsResponse - BalanceTimeTransactionDecimalThe account's original available balance, before the transaction has processed, less any holds on the account before the transaction has processed

First Available Version: GetTransactionDetailsResponse - CardholderNameStringThe name of the cardholder for whom the transaction is for (may be the employee or a dependent). Will be in the format of "LastName, FirstName"

First Available Version: GetTransactionDetailsResponse - CardNumberStringBenefits Card number

First Available Version: GetTransactionDetailsResponse - DeniedAmountDecimalThe amount of the claim that was denied by the claims processor.

First Available Version: GetTransactionDetailsResponse - DeniedReasonStringReason the transaction or part of a transaction was denied

First Available Version: GetTransactionDetailsResponse - DisplayDateDateTimeDate for the transaction that is displayed to the employee and employer

First Available Version: GetTransactionDetailsResponse - DisplayToEmployeeBooleanIndicates if transaction will display on WCP/WCM or returned on the participant APIs.

0 (False) - transaction will not be included/will not be displayed to the participant

1 (True) - transaction will be included/displayed to the participantFirst Available Version: GetTransactionDetailsResponse - EmployeeNameStringFirst and last name of the employee

First Available Version: GetTransactionDetailsResponse - ErrorCodeStringError code and description indicating why a transaction was not approved. If the transaction was successful, "0 - Approved" will be returned.

First Available Version: GetTransactionDetailsResponse - ExceptionTypeStringType of exception. Value will be "None" if there was no exception. Valid values are:

None

Employee

Terminal

Merchant

Plan DesignFirst Available Version: GetTransactionDetailsResponse - ExpirationDateStringExpiration date of the card

First Available Version: GetTransactionDetailsResponse - FeeDecimalIndicates if a per transaction fee was paid and amount.

First Available Version: GetTransactionDetailsResponse - FeePaidByEnumerationIndicates who paid the convenience fee if a fee was taken:

None

Administrator

Employer

EmployeeFirst Available Version: GetTransactionDetailsResponse - MerchantCityStringCity where the originating terminal resides. Available only when returned from the terminal.

First Available Version: GetTransactionDetailsResponse - MerchantIdStringUnique number assigned by Visa/MasterCard identifying the submitting merchant

First Available Version: GetTransactionDetailsResponse - MerchantNameStringName assigned to the merchant ID. Merchant name that shows on transaction.

First Available Version: GetTransactionDetailsResponse - MerchantStateStringState where the originating terminal resides. Available only when returned from the terminal.

First Available Version: GetTransactionDetailsResponse - MerchantTypeCodeStringAlso referred to as Merchant Category Code. Indicates the type of merchant submitting the transaction. The identifier is encoded into the terminal by the issuing bank and transmitted with every transaction.

Note: If the transaction was accepted because of a terminal, merchant, or employee exception, the code is considered a converted MTC. The code is designated as MCC for MasterCard and SIC for Visa.First Available Version: GetTransactionDetailsResponse - NotesStringNotes on transaction

First Available Version: GetTransactionDetailsResponse - OriginalMerchantTypeCodeStringThe Terminal Merchant Type Code that had its MTC code converted. This occurs in the case of allowing specific terminals, merchants and employee exceptions.

First Available Version: GetTransactionDetailsResponse - SequenceNumberIntegerSequential number assigned by the settlement system within a Settlement Date.

First Available Version: GetTransactionDetailsResponse - ServiceEndDateDateTime (yyyy-mm-ddThh:mm:ss)If the service the transaction is for expanded over multiple days, this is the last day of service

First Available Version: GetTransactionDetailsResponse - ServiceStartDateDateTime (yyyy-mm-ddThh:mm:ss)The start date of the service received

First Available Version: GetTransactionDetailsResponse - SettlementDateString (yyyymmdd)Date transaction was settled in WCA, also used in conjunction with the Settlement Sequence Number as a unique key for each transaction.

First Available Version: GetTransactionDetailsResponse - StatusEnumerationType of transaction. Valid values are:

Purchase

Pre-auth

Force post

RefundsFirst Available Version: GetTransactionDetailsResponse - StatusDateTimeDateTime (yyyy-mm-ddThh:mm:ss)The date and time of the most recent adjudication activity

First Available Version: GetTransactionDetailsResponse - TerminalIdStringTerminal ID as known by the network, returned from the originiating terminal.

First Available Version: GetTransactionDetailsResponse - TpaIdStringA unique identifer for your administrator instance, generated by WCA when the instance was first set up.

First Available Version: GetTransactionDetailsResponse - TrackingNumberStringTracking Number assigned by the system importing the transaction to WCA

First Available Version: GetTransactionDetailsResponse - TransactionAmountDecimalAmount of this transaction.

Note: If this amount is less than the amount for the original transaction, this transaction has been split.First Available Version: GetTransactionDetailsResponse - TransactionDateTimeDateTime (yyyy-mm-ddThh:mm:ss)The date/time that the transaction was received by WCA

First Available Version: GetTransactionDetailsResponse - TransactionTypeStringFor claims, the SCC description + the Merchant name (Note: a

tag is included to separate the two fields).

For Card transactions, the Merchant Name.

For other transactions, the type of transactionFirst Available Version: GetTransactionDetailsResponse - UserUpdatingStatusStringUser ID of person who changed the Transaction Status of this transaction

First Available Version: GetTransactionDetailsResponse - TotalAuthorizedAmountOriginalDecimalOriginal Merchant Requested Amount Authorized

First Available Version: GetTransactionDetailsResponse_2007_12 - HetAmountOriginalDecimalFor an IIAS transaction, this is the Healthcare Eligible Total (HET) requested/provided by the merchant.

First Available Version: GetTransactionDetailsResponse_2007_12 - HetAmountDecimalFor an IIAS transaction, this is the Healthcare Eligible Total (HET) applied to the account for this transaction.

First Available Version: GetTransactionDetailsResponse_2007_12 - RxAmountOriginalDecimalFor an IIAS transaction, this field will specify the original prescription amount

First Available Version: GetTransactionDetailsResponse_2007_12 - RxAmountDecimalFor an IIAS transaction, this field will specify the prescription amount that was approved

First Available Version: GetTransactionDetailsResponse_2007_12 - DentalAmountOriginalDecimalFor an IIAS transaction, this will be the original dental amount. Will be 0 if not populated.

First Available Version: GetTransactionDetailsResponse_2007_12 - DentalAmountDecimalFor an IIAS transaction, this will be the dental amount approved. Will be 0 if not populated.

First Available Version: GetTransactionDetailsResponse_2007_12 - VisionAmountOriginalDecimalFor an IIAS transaction, this will be the original vision amount. Will be 0 if not populated.

First Available Version: GetTransactionDetailsResponse_2007_12 - VisionAmountDecimalFor an IIAS transaction, this will be the vision amount approved. Will be 0 if not populated.

First Available Version: GetTransactionDetailsResponse_2007_12 - PartialAuthIndicatorBooleanIndicator received from a merchant, indicating if partial authorization is allowed.

0 (False)

1 (True)First Available Version: GetTransactionDetailsResponse_2007_12 - PartialAuthorizedBooleanIndicates if the transaction was partially authorized

0 (False)

1 (True)First Available Version: GetTransactionDetailsResponse_2007_12 - TpsErrorCodeIntegerReal time adjudication code

First Available Version: GetTransactionDetailsResponse_2007_12 - OffsetAmountDecimalIf using offset eligibility, this will be the Offset Amount. This is the amount remaining after offsetting. For completely offset transactions, the amount will be 0.

First Available Version: GetTransactionDetailsResponse_2007_12 - ReimbursementMethodEnumerationThe reimbursement method used to reimburse the transaction. Possible values:

None

Check

DirectDeposit

ExternalCheck

ExternalDirectDepositFirst Available Version: GetTransactionDetailsResponse_2007_12 - CheckNumberIntegerIf applicable, this will be the check number for the claim that was reimbursed.

First Available Version: GetTransactionDetailsResponse_2007_12 - CheckReissueIntegerIndicates if a check was reissued for the reimbursement.

0 - check was not reissued

1 - check was reissuedFirst Available Version: GetTransactionDetailsResponse_2007_12 - ReimbursementDateIntegerThe date a claim was reimbursed. Will be in the format of yyyymmdd if populated; 0 will be populated if there is no reimbursement.

First Available Version: GetTransactionDetailsResponse_2007_12 - DepositSubTypeIdStringDeposit Sub Type ID. No value will be sent if there is not a deposit subtype for the transaction.

First Available Version: GetTransactionDetailsResponse_2008_07 - DeductibleAmountDecimalAmount of this claim that was applied to the deductible on this account.

First Available Version: GetTransactionDetailsResponse_2008_07 - BypassDeductibleIndicatorBooleanIndicates if the deductible was bypassed or not

0 (False) – Do not bypass (apply toward deductible as appropriate)

1 (True) – Bypass Deductible (claim not applicable to the deductible and was eligible to be paid) Indicates whether this transaction used deductible rules when it was applied to the account or if it was paid out directly (was not applicable to the deductible).First Available Version: GetTransactionDetailsResponse_2008_07 - ReduceByBalanceMaxBooleanFor rollover deposits, indicates if the amount rolled over was reduced due to the balance of the account meeting or exceeding the maximum balance.

First Available Version: GetTransactionDetailsResponse_2008_07 - FundRolloverTypeShort0= Non-rollover transaction

1 = Primary Fund Rollover

2 = Secondary Fund Rollover (FUTURE)First Available Version: GetTransactionDetailsResponse_2008_07 - RolloverDepositsPtdDecimalDeposits made Year to Date INTO this account via Fund Rollover.

For an Individual/Family HRA plan, this is the Individual Fund information– If a Dependent ID is provided, then this is the Dependent’s individual Fund information.First Available Version: GetTransactionDetailsResponse_2008_07 - FamilyRolloverDepositsPtdDecimalIndividual/Family HRA plans only. Deposits made Year to Date INTO this account via Fund Rollover.

First Available Version: GetTransactionDetailsResponse_2008_07 - ServiceCategoryCodeStringThe alphanumeric SCC assigned to a manual claim.

First Available Version: GetTransactionDetailsResponse_2008_07 - ServiceCategoryCodeDescriptionStringThe description for the SCC.

First Available Version: GetTransactionDetailsResponse_2008_07 - ManualClaimNumberStringA system generated number assigned to a manual claim once that claim is successfully submitted.

Consists of YYYYMMDD +

INCREMENT, where INCREMENT is a sequential number. For example, if the first claim of the day was submitted on 19 March 2008, then the # would be 200803191.

Note; Both the tracking number and Manual claim number appear on the latest version (July, 2008) of the Manual Claim Denial Letter.First Available Version: GetTransactionDetailsResponse_2008_07 - DocumentTrackingNumbersStringWCA generated unique number to identify receipt notification or reminder letter documents in which this transaction was shown. Each tracking number is separated by a pipe (|) character.

First Available Version: GetTransactionDetailsResponse_2008_07 - CrossOverClaimBooleanIndicates if this is a crossover claim, where the payment was automatically deducted from the participant's account

0 (False)

1 (True)First Available Version: GetTransactionDetailsResponse_2009_04 - TermDteStringDate the participant is no longer eligible for the plan type within WealthCare Admin.

First Available Version: GetTransactionDetailsResponse_2010_04 - EligDteStringDate upon which the employee is eligible to elect benefits. This existing field is being updated to validate that it is prior to the termination date.

First Available Version: GetTransactionDetailsResponse_2010_04 - PendedAmountDecimalPended Amount of Claim

First Available Version: GetTransactionDetailsResponse_2010_04 - PendedReasonStringReason Code for the Pended Amount

First Available Version: GetTransactionDetailsResponse_2010_04 - FlexAcctIdStringA uniue identifer for the account, generated by WCA when the account was created.

First Available Version: GetTransactionDetailsResponse_2010_04 - PatientIDStringThe provider's patient identification number, to be used for provider payments.

First Available Version: GetTransactionDetailsResponse_2010_10 - PayProviderFlagStringIndicates whether the transaction was reimbursed to a provider or directly to the participant.

0/False = Reimbursement should go to participant

1/True = Reimbursement should go to provider. Provider ID must be included.First Available Version: GetTransactionDetailsResponse_2010_10 - ProviderAddress1StringAddress line 1 associated with the provider’s mailing address

First Available Version: GetTransactionDetailsResponse_2010_10 - ProviderAddress1StringAddress line 2 associated with the provider’s mailing address

First Available Version: GetTransactionDetailsResponse_2010_10 - ProviderCityStringCity associated with the provider’s mailing address

First Available Version: GetTransactionDetailsResponse_2010_10 - ProviderStateString

State associated with the provider’s mailing addressFirst Available Version: GetTransactionDetailsResponse_2010_10 - ProviderZipString

Zip Code associated with the provider’s mailing addressFirst Available Version: GetTransactionDetailsResponse_2010_10 - ProviderPhoneStringPhone number associated with the provider

First Available Version: GetTransactionDetailsResponse_2010_10 - CheckClearedDteStringYYYYMMDD - The Check Cleared Date for a reimbursement check.

First Available Version: GetTransactionDetailsResponse_2012_03 - ExternalClaimNumberStringExternal Claim Number

First Available Version: GetTransactionDetailsResponse_2012_10 - PinNetworkIndicatorBooleanIndicate whether the transaction is a PIN based or signature based transaction.

True = PIN Based

False = Signature BasedFirst Available Version: GetTransactionDetailsResponse_2013_02 - ExcludeFromEmployerFundingBooleanIndicates if the transaction was included in employer funding calculations

0 (False) - transaction was included in employer funding calculations

1 (True) - transaction was excluded in employer funding calculationsFirst Available Version: GetTransactionDetailsResponse_2013_06 - StatusStringA code used to provide more detail about the transaction. Refer to the Transaction Status Code table for more information.

First Available Version: GetTransactionDetailsResponse_2015_02 - HSAPostingDateStringPosting date, for HSA transactions only

First Available Version: GetTransactionDetailsResponse_2015_02 - HSACodeDescriptionStringThe human-friendly description for the IRS reporting category associated with the HSA account transaction, derived from the transaction type or the product partner HSA Status Code. For HSA transactions only.

First Available Version: GetTransactionDetailsResponse_2015_02 - HSACodeIntThe numeric code for the IRS reporting category associated with the HSA account transaction, derived from the transaction type or the product partner HSA Status Code. For HSA transactions only.

First Available Version: GetTransactionDetailsResponse_2015_02 - HSATransactionStatusString

First Available Version: GetTransactionDetailsResponse_2015_02 - HSAReasonForNonPostDescriptionStringWhen an HSA transaction is in a status of non-post, this field will include a human friendly description indicating why it was a non-post. This field orresponds with HSAReasonForNonPostCode. For HSA transactions only.

First Available Version: GetTransactionDetailsResponse_2015_02 - HSAReasonForNonPostCodeIntWhen an HSA transaction is in a status of non-post, this field will include a numeric code indicating why it was a non-post. This field corresponds with HSAReasonForNonPostDescription. For HSA transactions only.

First Available Version: GetTransactionDetailsResponse_2015_02 - PostingTypeStringIndicates the type of transaction

Credit

Debit

BothFirst Available Version: GetTransactionDetailsResponse_2015_02 - GLAccountStringThe name of the general ledger account used for settlement. For HSA transactions only.

First Available Version: GetTransactionDetailsResponse_2015_02 - HoldAmountDecimalThe total amount in holds on the account

First Available Version: GetTransactionDetailsResponse_2015_02 - LinkTxnKeyStringFor a linked transction, this will be the unique identifer for the transaction linked to this one

First Available Version: GetTransactionDetailsResponse_2016_06 - TxnKeyStringA unique identifier generated by WCA for the transaction

First Available Version: GetTransactionDetailsResponse_2016_06 - TaxYearStringProvides the tax year for non-HSA transactions that a reimbursement should be applied to. This feature is specific to the pre/post tax plan configuration options.

First Available Version: GetTransactionDetailsResponse_2021_02 - PreTaxAmtStringAmount that is considered pre-tax for the transaction based on pre/post tax business rules on the plan.

First Available Version: GetTransactionDetailsResponse_2021_02 - PostTaxAmtStringPortion of the transaction that should be added as taxable income on the employee’s W2. This amount is based on the plan setting in WCA.

First Available Version: GetTransactionDetailsResponse_2021_02

Example of a GetTransactionDetails SOAP request message:

Coming soon!

Example of a GetTransactionDetails SOAP response message:

Coming soon!

Example client code

The following is an example of the client code

(using a .NET proxy class to connect to the service) used when submitting a

claim to the GetTransactionDetails method.

Coming soon!

When processing manual claims (non-POS claims), you must import the claim into WCA to verify available funds prior to cutting a check to the employee. Below are some points of interest about the method.

- The tracking number field may be used by the administrator for any reason. Alegeus does not use the field. Some administrators use the tracking number for claim numbers.

- If a claim is denied due to insufficient funds and the account allows for partial transaction then the transaction is re-submitted using the available amount. Note that if the second transaction was successful, then a warning is returned.

- WCA does not check for duplicate manual transactions through the data transfer process. It is the responsibility of the calling application not to send duplicate manual transactions.

History

The SubmitManualClaim methods are listed below:

- SubmitManualClaim_2013_06

- SubmitManualClaim_2012_10

- SubmitManualClaim_2011_12

- SubmitManualClaim_2011_10

- SubmitManualClaim_2010_10

- SubmitManualClaim_2009_04

- SubmitManualClaim_2008_07

- SubmitManualClaim_2007_12

- SubmitManualClaimRequest_2006_05

- SubmitManualClaimRequest

- SubmitManualClaimResponse

SubmitManualClaim Request/Response Messages

The SubmitManualClaim

method requires the following request and response messages (input and

output data).

- SubmitManualClaim_2010_10

- SubmitManualClaim_2009_04

- SubmitManualClaim_2008_07

- SubmitManualClaim_2007_12

- SubmitManualClaimRequest_2006_05

- SubmitManualClaimRequest

Request Body

- AccountTypeCodeStringrequiredThree character abbreviation that indicates the type of account (FSA, DCA, TRN, HRA, etc.) that the transaction was processed against.

First Available Version: SubmitManualClaimRequest Max Length: 4 - ApprovedClaimAmountDecimalrequiredApproved amount of claim/transaction.

First Available Version: SubmitManualClaimRequest - EmployeeIdStringconditionally requiredEmployee's ID in WCA. Required if this field is being used as the unique cardholder identifier and card number is not provided. Either this field or Employee SSN is required.

First Available Version: SubmitManualClaimRequest_2011_10 Max Length: 30 - EmployeeSocialSecurityNumberStringconditionally requiredEmployee's social security number. Required if this field is being used as the unique cardholder identifier and card number is not provided. Either this field or Employee ID is required.

First Available Version: SubmitManualClaimRequest_2011_10 Max Length: 9 - DependentIdStringconditionally requiredDependent's ID in WCA. Required if this field is being used as the unique cardholder identifier and card number is not provided.

Either this field or Dependent SSN may be used for this purpose. If this was not a dependent transaction, this field can be ignored.First Available Version: SubmitManualClaimRequest_2011_10 Max Length: 30 - DependentSocialSecurityNumberStringconditionally requiredDependent's social security number. Required if this field is being used as the unique cardholder identifier and card number is not provided.

Either this field or Dependent ID may be used for this purpose. If this was not a dependent transaction, this field can be ignored.First Available Version: SubmitManualClaimRequest_2011_10 Max Length: 9 - CardholderIDStringconditionally requiredReplaced by Employee/Dependent ID fields in version 2011_10.